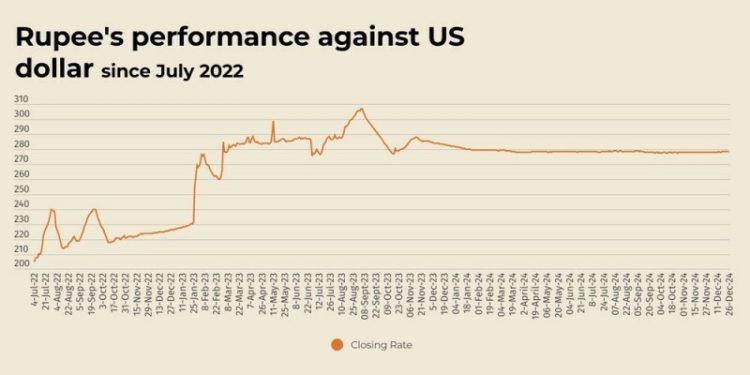

The Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Thursday.

At close, the currency settled at 278.37 for a gain of Re0.10 against the greenback.

The rupee settled at 278.47 on Tuesday, according to the State Bank of Pakistan (SBP).

The currency market remained closed on Wednesday on account of public holiday.

Internationally, the US dollar was perched near a two-year high against a basket of currencies at 108.15, and was on track for a monthly gain of more than 2%.

The Australian and New Zealand dollars were meanwhile among the biggest losers against a dominant greenback on Thursday, with the Aussie falling 0.45% to $0.6241. The kiwi slid 0.51% to $0.5650.

The euro eased 0.18% to $1.0398, while the yen languished near a five-month low and last stood at 157.45 per the US dollar.

Since Fed Chair Jerome Powell primed markets for fewer rate cuts next year at the central bank’s last policy meeting of the year, traders are now pricing in just about 35 basis points worth of easing for 2025.

That has in turn lifted US Treasury yields and the US dollar, with the greenback’s renewed strength a burden for commodities and gold.

The benchmark 10-year yield was last steady at 4.5967%, having risen above 4.6% for the first time since May 30 earlier in the week. It is up roughly 40 basis points for the month thus far. The two-year yield similarly firmed at 4.3407%.

Oil prices, a key indicator of currency parity, edged higher on Thursday in thin holiday trade driven by hopes for additional fiscal stimulus in China, the world’s biggest oil importer, and supported by an industry report showing a decline in US crude inventories.

Chinese authorities have agreed to issue 3 trillion yuan ($411 billion) worth of special treasury bonds next year, Reuters reported on Tuesday, citing two sources, as Beijing ramps up fiscal stimulus to revive a faltering economy.

Brent crude futures rose 39 cents, or 0.5%, to $73.97 a barrel by 0917 GMT.

US West Texas Intermediate crude was at $70.46, up 0.5%, or 36 cents, from Tuesday’s pre-Christmas settlement.

The Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Thursday.

At close, the currency settled at 278.37 for a gain of Re0.10 against the greenback.

The rupee settled at 278.47 on Tuesday, according to the State Bank of Pakistan (SBP).

The currency market remained closed on Wednesday on account of public holiday.

Internationally, the US dollar was perched near a two-year high against a basket of currencies at 108.15, and was on track for a monthly gain of more than 2%.

The Australian and New Zealand dollars were meanwhile among the biggest losers against a dominant greenback on Thursday, with the Aussie falling 0.45% to $0.6241. The kiwi slid 0.51% to $0.5650.

The euro eased 0.18% to $1.0398, while the yen languished near a five-month low and last stood at 157.45 per the US dollar.

Since Fed Chair Jerome Powell primed markets for fewer rate cuts next year at the central bank’s last policy meeting of the year, traders are now pricing in just about 35 basis points worth of easing for 2025.

That has in turn lifted US Treasury yields and the US dollar, with the greenback’s renewed strength a burden for commodities and gold.

The benchmark 10-year yield was last steady at 4.5967%, having risen above 4.6% for the first time since May 30 earlier in the week. It is up roughly 40 basis points for the month thus far. The two-year yield similarly firmed at 4.3407%.

Oil prices, a key indicator of currency parity, edged higher on Thursday in thin holiday trade driven by hopes for additional fiscal stimulus in China, the world’s biggest oil importer, and supported by an industry report showing a decline in US crude inventories.

Chinese authorities have agreed to issue 3 trillion yuan ($411 billion) worth of special treasury bonds next year, Reuters reported on Tuesday, citing two sources, as Beijing ramps up fiscal stimulus to revive a faltering economy.

Brent crude futures rose 39 cents, or 0.5%, to $73.97 a barrel by 0917 GMT.

US West Texas Intermediate crude was at $70.46, up 0.5%, or 36 cents, from Tuesday’s pre-Christmas settlement.

American Dollar Exchange Rate

American Dollar Exchange Rate