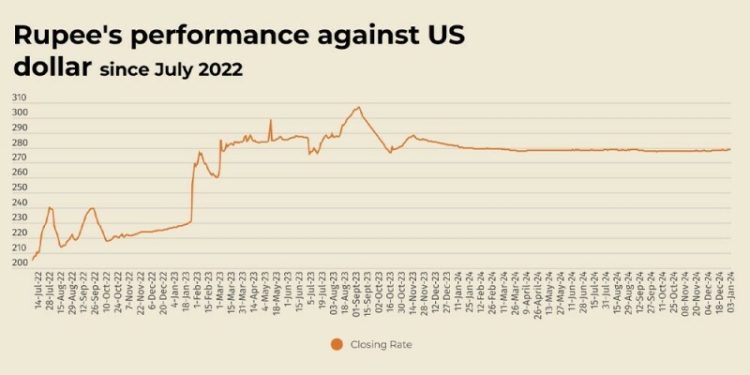

The Pakistani rupee registered a marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Friday.

At close, the currency settled at 278.56 for a gain of Re0.08 against the greenback.

The rupee settled at 278.64 on Thursday, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was on track for its best weekly performance in over a month on Friday, underpinned by expectations of fewer Federal Reserve rate cuts this year and the view that the US economy will continue to outperform the rest of its peers globally.

The greenback began the new-year on a strong note reaching a more than two-year high of 109.54 against a basket of currencies on Thursday as it extended a stellar rally from last year.

Its charge higher has come on the back of a more hawkish Fed and a resilient US economy.

Ahead of US President-elect Trump’s inauguration on Jan. 20, markets have taken his impending return to office with caution due to uncertainty over his plans for hefty import tariffs, tax cuts and immigration restrictions.

That has in turn given the greenback additional safe-haven support.

The dollar index last stood at 109.18 and was on track for a weekly gain of 1.1%, its strongest since November.

Oil prices, a key indicator of currency parity, barely budged on Friday after closing at their highest in more than two months in the prior session, amid hopes that governments worldwide may increase policy support to revive economic growth that would lift fuel demand.**

Brent crude futures edged up 1 cent to $75.94 a barrel by 0720 GMT, after settling at its highest since Oct. 25 on Thursday.

US West Texas Intermediate crude was also up 1 cent at $73.14 a barrel, with Thursday’s close its highest since Oct. 14.

Both contracts are on track for their second weekly increase after investors returned from holidays, improving trade liquidity.

Inter-bank market rates for dollar on Friday

BID Rs 278.56

OFFER Rs 278.76

Open-market movement

In the open market, the PKR lost 14 paise for buying and 15 paise for selling against USD, closing at 278.07 and 279.85, respectively.

Against Euro, the PKR gained 2.03 rupees for buying and 2.06 rupees for selling, closing at 285.72 and 288.30, respectively.

Against UAE Dirham, the PKR lost 3 paise for buying and 5 paise for selling, closing at 75.66 and 76.15, respectively.

Against Saudi Riyal, the PKR lost 3 paise for buying and 5 paise for selling, closing at 73.98 and 74.45, respectively.

Open-market rates for dollar on Friday

BID Rs 278.07

OFFER Rs 279.85