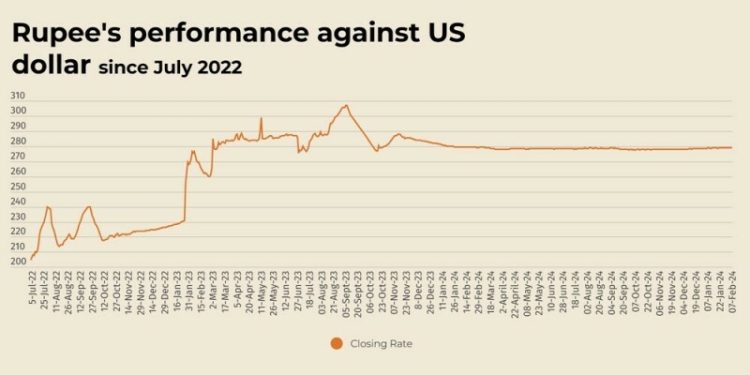

The Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Friday.

At close, the currency settled at 279.05 for a gain of Re0.10 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 279.15 on Thursday.

Internationally, the yen climbed to a nine-week high as market players piled on bets for more interest rate hikes in Japan this year, while the US dollar and other major currencies trod water ahead of US monthly payrolls figures due later in the day.

After a volatile week punctuated by back-and-forth market-moving headlines on US tariff threats, traders settled in for the US jobs data while they kept a wary eye on geopolitics and US President Donald Trump’s broad policy moves.

The US labour market has remained resilient. Economists polled by Reuters expect the unemployment rate in January to have stayed steady at 4.1% while projecting the economy added 170,000 jobs.

But analysts say that January employment data may be difficult to interpret.

The dollar index, which measures the US currency against the yen, sterling and other major peers, stood flat at 107.69 after soaring as high as 109.88 on the back of U.S. tariff threats earlier this week.

Oil prices, a key indicator of currency parity, rose marginally in Asian trade on Friday but were on track for a third straight week of decline, hurt by US President Donald Trump’s renewed trade war on China and threats of tariff hikes on other countries.

Brent crude futures were up 52 cents at $74.81 a barrel by 0735 GMT, but were poised to fall 2.5% this week. US West Texas Intermediate crude rose 44 cents to $71.05 a barrel, down about 2% on a weekly basis.

Inter-bank market rates for dollar on Friday

BID Rs 279.05

OFFER Rs 279.25

Open-market movement

In the open market, the PKR lost 3 paise for buying and remained unchanged for selling against USD, closing at 278.69 and 280.90, respectively.

Against Euro, the PKR lost 11 paise for buying and 17 paise for selling, closing at 289.03 and 292.09, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 75.96 and 76.50, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 74.21 and 74.75, respectively.

Open-market rates for dollar on Friday

BID Rs 278.69

OFFER Rs 280.90

The Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Friday.

At close, the currency settled at 279.05 for a gain of Re0.10 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 279.15 on Thursday.

Internationally, the yen climbed to a nine-week high as market players piled on bets for more interest rate hikes in Japan this year, while the US dollar and other major currencies trod water ahead of US monthly payrolls figures due later in the day.

After a volatile week punctuated by back-and-forth market-moving headlines on US tariff threats, traders settled in for the US jobs data while they kept a wary eye on geopolitics and US President Donald Trump’s broad policy moves.

The US labour market has remained resilient. Economists polled by Reuters expect the unemployment rate in January to have stayed steady at 4.1% while projecting the economy added 170,000 jobs.

But analysts say that January employment data may be difficult to interpret.

The dollar index, which measures the US currency against the yen, sterling and other major peers, stood flat at 107.69 after soaring as high as 109.88 on the back of U.S. tariff threats earlier this week.

Oil prices, a key indicator of currency parity, rose marginally in Asian trade on Friday but were on track for a third straight week of decline, hurt by US President Donald Trump’s renewed trade war on China and threats of tariff hikes on other countries.

Brent crude futures were up 52 cents at $74.81 a barrel by 0735 GMT, but were poised to fall 2.5% this week. US West Texas Intermediate crude rose 44 cents to $71.05 a barrel, down about 2% on a weekly basis.

Inter-bank market rates for dollar on Friday

BID Rs 279.05

OFFER Rs 279.25

Open-market movement

In the open market, the PKR lost 3 paise for buying and remained unchanged for selling against USD, closing at 278.69 and 280.90, respectively.

Against Euro, the PKR lost 11 paise for buying and 17 paise for selling, closing at 289.03 and 292.09, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 75.96 and 76.50, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 74.21 and 74.75, respectively.

Open-market rates for dollar on Friday

BID Rs 278.69

OFFER Rs 280.90