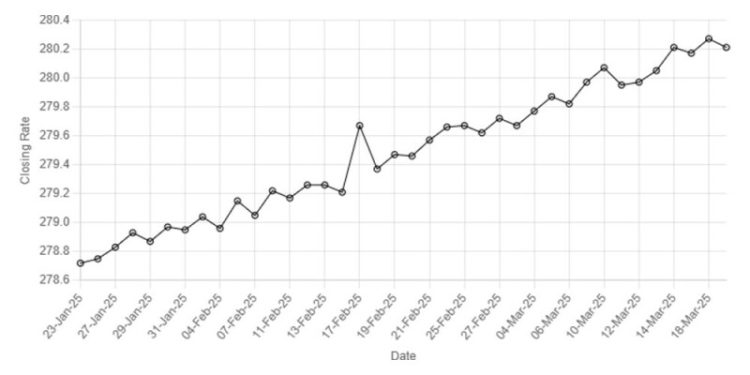

Rupee’s Performance Against US Dollar Since 23 Jan 2025

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Wednesday.

At close, the currency settled at 280.21, a gain of Re0.06 against the greenback.

On Tuesday, the rupee had closed at 280.27.

Internationally, the US dollar struggled to regain some lost ground ahead of key rate decisions from the Bank of Japan (BOJ) and the Federal Reserve later in the day.

Overnight, Israeli airstrikes pounded Gaza and killed more than 400 people, US President Donald Trump and Russian President Vladimir Putin failed to reach an agreement on a Ukraine ceasefire and Germany’s outgoing parliament approved plans for a massive spending surge.

But currency moves were largely subdued as traders were hesitant to take on fresh positions ahead of Wednesday’s two main central bank events, particularly the Fed’s.

The euro did scale a five-month high of $1.0955 in the previous session and last traded near that level at $1.0937, as investors were optimistic the move in Germany could revive economic growth and scale up military spending for a new era of European collective defence.

Against a basket of currencies, the dollar edged slightly higher to 103.33, though was languishing near Tuesday’s five-month low of 103.19.

The US dollar has fallen nearly 4% for the month, pressured by Trump’s erratic tariff moves and as fears of a recession in the world’s largest economy mount.

The Fed’s policy decision later on Wednesday will be crucial for investors eager to know what the central bank makes of Trump’s policies and their impact on the U.S. economy, and how that would translate to the rate outlook.

Fed policymakers are widely expected to keep rates on hold, and will also release new economic projections after the meeting later in the day.

Oil prices, a key indicator of currency parity, fell on Wednesday after Russia agreed to US President Donald Trump’s proposal that Moscow and Kyiv temporarily stop attacking each other’s energy infrastructure, a move that could eventually pave the way for Russian oil to enter global markets.

Brent crude futures were down 59 cents, or 0.84%, to $69.97 a barrel at 0924 GMT. US West Texas Intermediate crude (WTI) was down 60 cents, or 0.90%, at $66.30.

Inter-bank market rates for dollar on Wednesday

BID Rs 280.20

OFFER Rs 280.40

Open-market movement

In the open market, the PKR lost 10 paise for buying and gained 1 paisa for selling against USD, closing at 280.12 and 282.06, respectively.

Against Euro, the PKR gained 26 paise for buying and lost 15 paise for selling, closing at 305.14 and 308.27, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 76.23 and 76.80, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and lost 1 paisa for selling, closing at 74.71 and 75.29, respectively.

Open-market rates for dollar on Wednesday

BID Rs 280.12

OFFER Rs 282.06

American Dollar Exchange Rate

American Dollar Exchange Rate