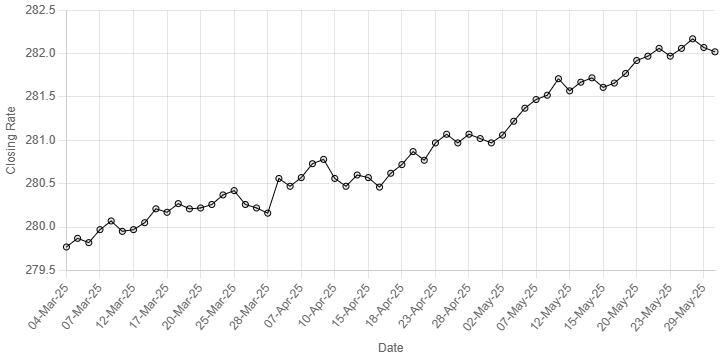

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee registered marginal gain against the US dollar, appreciating 0.02% in the inter-bank market on Friday.

At close, the local currency settled at 282.02, a gain of Re0.05 against the greenback.

On Thursday, the Pakistani rupee closed the day at 282.07.

Internationally, the US dollar softened on Friday, heading for its fifth-straight monthly decline as traders braced for further bouts of uncertainty around trade and fiscal health, while investors awaited a pivotal inflation report later in the day.

The greenback had a choppy week, ending lower in the previous session after a federal court temporarily reinstated the most sweeping of President Donald Trump’s tariffs, a day after a separate trade court had ordered an immediate block on tariffs.

Trump on Thursday criticised the trade court’s decision and said he hoped the Supreme Court would overturn the decision.

The uncertainty around tariffs has taken a vice-like grip on the markets as investors flee U.S. assets looking for alternatives, worried that Trump’s erratic policies could challenge the strength and outperformance of US markets.

On Friday, the euro was slightly firmer at $1.1378, while the Swiss franc was also stronger at 0.8216 per dollar.

The US currency was set for monthly declines against the Swiss franc, the euro, and the pound.

The dollar index, which tracks the US unit against a basket of six other currencies, was muted on the day. The index was set for a decline of 0.4% in May, on course for its fifth month in the red.

Oil prices, a key indicator of currency parity, were on track to end the week down more than 1% on Friday amid whipsawing tariff rulings in the US and as the market braced for a potential OPEC+ output hike.

Brent crude futures slipped 26 cents, or 0.41%, to $63.89 a barrel by 0104 GMT. US West Texas Intermediate crude fell 27 cents, or 0.44%, to $60.67 a barrel.

The Brent July futures contract is due to expire on Friday.

Inter-bank market rates for dollar on Friday

BID Rs 282.02

OFFER Rs 282.22

Open-market movement

In the open market, the PKR gained 32 paise for buying and lost 1 paisa for selling against USD, closing at 282.60 and 284.40, respectively.

Against Euro, the PKR lost 1.53 rupee for buying and 2.00 rupees for selling, closing at 318.98 and 322.89, respectively.

Against UAE Dirham, the PKR gained 19 paise for buying and 8 paise for selling, closing at 76.71 and 77.51, respectively.

Against Saudi Riyal, the PKR gained 26 paise for buying and 15 paise for selling, closing at 74.89 and 75.73, respectively.

Open-market rates for dollar on Friday

BID Rs 282.60

OFFER Rs 284.40