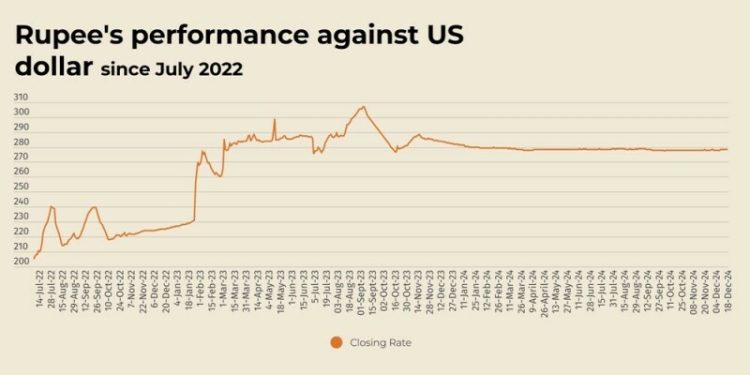

The Pakistani rupee remained largely stable against the US dollar, appreciating 0.01% in the inter-bank market on Wednesday.

At close, the currency settled at 278.23 for a gain of Re0.04 against the greenback.

On Tuesday, the rupee had settled at 278.27, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar held steady against the yen and other major rivals on Wednesday as investors waited to see whether the Federal Reserve will deliver a hawkish cut before the Bank of Japan and other central banks meet this week.

The Fed is widely expected to deliver a 25-basis-point

interest rate cut at the end of its two-day policy meeting on Wednesday, with markets pricing in a 97% probability, according to the CME’s FedWatch tool.

Focus will fall on policymakers’ new economic projections for the upcoming year released alongside the decision, namely how much further Fed officials think they will reduce rates in 2025.

Given the string of robust inflation and activity data, the Fed may signal a slower pace going ahead, revising projections to indicate three cuts in 2025 instead of the current four, Tony Sycamore, market analyst at IG, wrote in a note to clients.

Investors are also weighing the possible impact of promised tariffs and tax cuts by the incoming Trump administration on the Fed’s outlook.

The US dollar index, which measures the greenback against six rivals, was little changed, down 0.04% at 106.89 after hitting its highest since Nov. 26 at 107.18 on Monday.

Oil prices, a key indicator of currency parity, rose slightly on Wednesday as investors stayed cautious ahead of a potential interest rate cut by the US Federal Reserve, while a draw in US crude inventories offered further support.

Brent futures rose 57 cents, or 0.78%, to $73.56 a barrel at 0923 GMT, while US West Texas Intermediate crude climbed 63 cents, or 0.90%, to $70.71 a barrel.