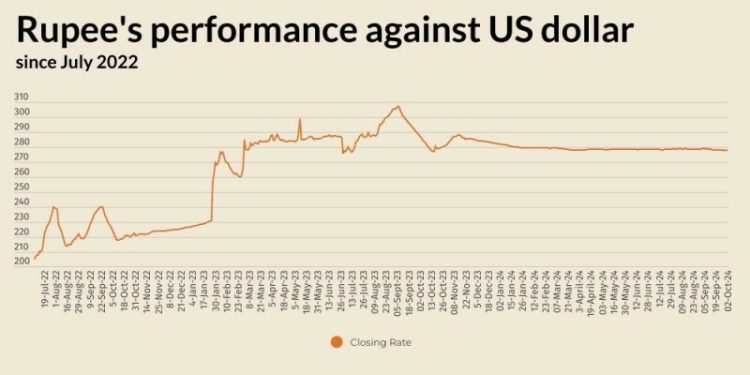

The Pakistani rupee remained largely stable against the US dollar on Wednesday, appreciating 0.02% in the inter-bank market.

At close, the currency settled at 277.64, a gain of Re0.05 against the US dollar.

On Tuesday, the rupee had settled at 277.69, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar held its sharpest gain in a week on Wednesday after an Iranian missile attack on Israel drove buying of safe assets as investors fretted about the widening of conflict in the Middle East.

Early Asia moves were slight, leaving the euro below $1.10 following its largest drop in nearly four months overnight.

The bid for safety kept the yen broadly steady at 143.45 per dollar and the Swiss franc at 0.8463 per dollar.

The US dollar index rose about 0.5% overnight to 101.2, its largest rise since Sept. 25, which was also helped by a stronger-than-expected reading on US job openings.

Oil prices, a key indicator of currency parity, climbed more than 2% on Wednesday on rising concerns that Middle East tensions could escalate, potentially disrupting crude output from the region, following Iran’s biggest ever military blow against Israel.

Brent futures leapt $1.63, or 2.2%, to $75.19 a barrel, while US West Texas Intermediate (WTI) crude spiked $1.70, or 2.4%, to $71.53 at 0755 GMT.

WTI had earlier risen more than $2.

The Pakistani rupee remained largely stable against the US dollar on Wednesday, appreciating 0.02% in the inter-bank market.

At close, the currency settled at 277.64, a gain of Re0.05 against the US dollar.

On Tuesday, the rupee had settled at 277.69, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar held its sharpest gain in a week on Wednesday after an Iranian missile attack on Israel drove buying of safe assets as investors fretted about the widening of conflict in the Middle East.

Early Asia moves were slight, leaving the euro below $1.10 following its largest drop in nearly four months overnight.

The bid for safety kept the yen broadly steady at 143.45 per dollar and the Swiss franc at 0.8463 per dollar.

The US dollar index rose about 0.5% overnight to 101.2, its largest rise since Sept. 25, which was also helped by a stronger-than-expected reading on US job openings.

Oil prices, a key indicator of currency parity, climbed more than 2% on Wednesday on rising concerns that Middle East tensions could escalate, potentially disrupting crude output from the region, following Iran’s biggest ever military blow against Israel.

Brent futures leapt $1.63, or 2.2%, to $75.19 a barrel, while US West Texas Intermediate (WTI) crude spiked $1.70, or 2.4%, to $71.53 at 0755 GMT.

WTI had earlier risen more than $2.