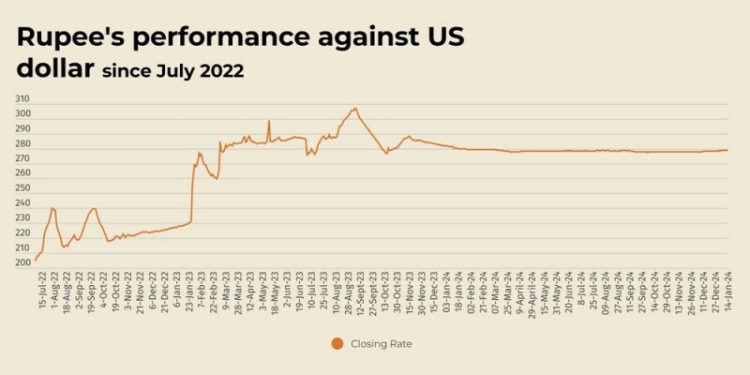

The Pakistani rupee remained largely stable against the US dollar, depreciating 0.01% in the inter-bank market on Tuesday.

At close, the currency settled at 278.72 after a loss of Re0.04 against the greenback.

The rupee closed at 278.68 on Monday, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar hung near its highest in more than two years on Tuesday as traders scaled back US rate cuts in 2025 after strong economic data, while investor worries about Britain’s fiscal health kept frail sterling in the spotlight.

With President-elect Donald Trump set to step back into the White House next week, the focus has been on his policies that analysts expect will boost growth but add to price pressures.

The threat of tariffs along with the Federal Reserve’s stated measured approach to rate cuts this year have lifted Treasury yields and the dollar, putting the euro, pound, yen and yuan under pressure.

The dollar index, which measures the US currency versus six other units, was 0.16% higher at 109.59, not far from the 26-month high of 110.17 it reached on Monday.

After a blowout jobs report on Friday reinforced support for the U.S. central bank’s cautious stance toward further monetary policy easing this year, investor focus will be on the inflation report due on Wednesday.

Traders are pricing in 29 basis points of easing this year, less than the 50 basis points the Fed projected in December, when it jolted the market with its measured approach to rate cuts due to inflation worries.

Oil prices, a key indicator of currency parity, eased on Tuesday but remained near four-month highs as the impact of fresh US sanctions on Russian oil remained the market’s main focus, ahead of US inflation data this week.

Brent futures slipped 53 cents, or 0.7%, to $80.48 a barrel by 0746 GMT, while US West Texas Intermediate (WTI) crude fell 44 cents, or 0.6% to $78.38 a barrel.

Prices jumped 2% on Monday after the US Treasury Department on Friday imposed sanctions on Gazprom Neft and Surgutneftegas as well as 183 vessels that trade oil as part of Russia’s so-called “shadow fleet” of tankers.

Inter-bank market rates for dollar on Tuesday

BID Rs 278.72

OFFER Rs 278.92

Open-market movement

In the open market, the PKR lost 31 paise for buying and 4 paise for

selling against USD, closing at 279.09 and 280.52, respectively.

Against Euro, the PKR lost 1.23 rupee for buying and 1.11 rupee for selling, closing at 285.51 and 288.34, respectively.

Against UAE Dirham, the PKR lost 3 paise for buying and remained unchanged for selling, closing at 75.90 and 76.36, respectively.

Against Saudi Riyal, the PKR lost 4 paise for buying and gained 2 paise for selling, closing at 74.20 and 74.60, respectively.

Open-market rates for dollar on Tuesday

BID Rs 279.09

OFFER Rs 280.52

The Pakistani rupee remained largely stable against the US dollar, depreciating 0.01% in the inter-bank market on Tuesday.

At close, the currency settled at 278.72 after a loss of Re0.04 against the greenback.

The rupee closed at 278.68 on Monday, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar hung near its highest in more than two years on Tuesday as traders scaled back US rate cuts in 2025 after strong economic data, while investor worries about Britain’s fiscal health kept frail sterling in the spotlight.

With President-elect Donald Trump set to step back into the White House next week, the focus has been on his policies that analysts expect will boost growth but add to price pressures.

The threat of tariffs along with the Federal Reserve’s stated measured approach to rate cuts this year have lifted Treasury yields and the dollar, putting the euro, pound, yen and yuan under pressure.

The dollar index, which measures the US currency versus six other units, was 0.16% higher at 109.59, not far from the 26-month high of 110.17 it reached on Monday.

After a blowout jobs report on Friday reinforced support for the U.S. central bank’s cautious stance toward further monetary policy easing this year, investor focus will be on the inflation report due on Wednesday.

Traders are pricing in 29 basis points of easing this year, less than the 50 basis points the Fed projected in December, when it jolted the market with its measured approach to rate cuts due to inflation worries.

Oil prices, a key indicator of currency parity, eased on Tuesday but remained near four-month highs as the impact of fresh US sanctions on Russian oil remained the market’s main focus, ahead of US inflation data this week.

Brent futures slipped 53 cents, or 0.7%, to $80.48 a barrel by 0746 GMT, while US West Texas Intermediate (WTI) crude fell 44 cents, or 0.6% to $78.38 a barrel.

Prices jumped 2% on Monday after the US Treasury Department on Friday imposed sanctions on Gazprom Neft and Surgutneftegas as well as 183 vessels that trade oil as part of Russia’s so-called “shadow fleet” of tankers.

Inter-bank market rates for dollar on Tuesday

BID Rs 278.72

OFFER Rs 278.92

Open-market movement

In the open market, the PKR lost 31 paise for buying and 4 paise for

selling against USD, closing at 279.09 and 280.52, respectively.

Against Euro, the PKR lost 1.23 rupee for buying and 1.11 rupee for selling, closing at 285.51 and 288.34, respectively.

Against UAE Dirham, the PKR lost 3 paise for buying and remained unchanged for selling, closing at 75.90 and 76.36, respectively.

Against Saudi Riyal, the PKR lost 4 paise for buying and gained 2 paise for selling, closing at 74.20 and 74.60, respectively.

Open-market rates for dollar on Tuesday

BID Rs 279.09

OFFER Rs 280.52