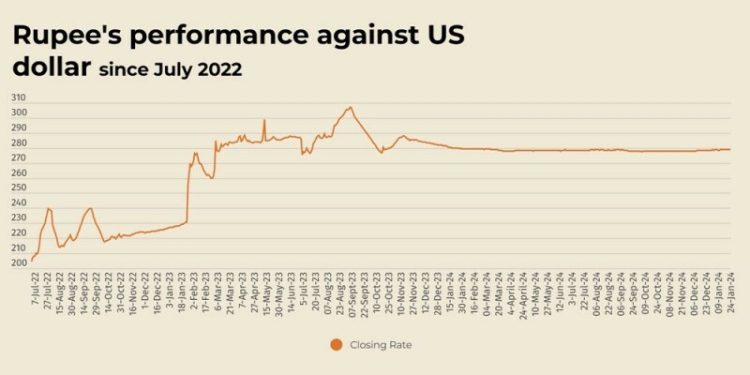

The Pakistani rupee remained largely stable against the US dollar, depreciating 0.01% in the inter-bank market on Friday.

At close, the currency settled at 278.75 for a loss of Re0.03 against the greenback.

According to the State Bank of Pakistan (SBP), the rupee closed at 278.72 on Thursday.

Globally, the Australian and New Zealand dollars rose on Friday as did the yuan, reacting to comments from US President Donald Trump that suggested a softer stance on tariffs against China, while the yen was on guard ahead of a Bank of Japan (BOJ) rate decision.

Trump said in an interview with Fox News aired on Thursday evening that he would rather not have to use tariffs over China, adding that he thought he could reach a trade deal with the world’s second-largest economy.

Trump’s remarks come just days before the Fed’s first policy meeting to be held during his administration, with very broad expectations officials will leave rates unchanged.

In the broader market, the US dollar was headed for its worst weekly fall in two months, after Trump’s widely expected tariff announcements did not materialise following his inauguration, unlike what he had threatened during his campaign.

The greenback was set to lose 1.4% against a basket of currencies, its steepest decline since November.

The US dollar index was last 0.23% lower at 107.89 on Friday.

Oil prices, a key indicator of currency parity, were little changed on Friday but headed for a weekly decline after US President Donald Trump issued a sweeping plan to boost US production and demanded OPEC lower crude prices.

Brent crude futures were up 6 cents at $78.35 a barrel at 0745 GMT, while US West Texas Intermediate crude (WTI) was 4 cents higher at $74.66.

For the week, Brent is down 3.07% so far, and WTI is down 4.17%.

Inter-bank market rates for dollar on Friday

BID Rs 278.75

OFFER Rs 278.95

Open-market movement

In the open market, the PKR gained 12 paise for buying and lost 8 paise for selling against USD, closing at 279.22 and 281.21, respectively.

Against Euro, the PKR lost 1.56 rupee for buying and 1.42 rupee for selling, closing at 290.92 and 294.28, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 75.96 and 76.55, respectively.

Against Saudi Riyal, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 74.24 and 74.80, respectively.

Open-market rates for dollar on Friday

BID Rs 279.22

OFFER Rs 281.21

The Pakistani rupee remained largely stable against the US dollar, depreciating 0.01% in the inter-bank market on Friday.

At close, the currency settled at 278.75 for a loss of Re0.03 against the greenback.

According to the State Bank of Pakistan (SBP), the rupee closed at 278.72 on Thursday.

Globally, the Australian and New Zealand dollars rose on Friday as did the yuan, reacting to comments from US President Donald Trump that suggested a softer stance on tariffs against China, while the yen was on guard ahead of a Bank of Japan (BOJ) rate decision.

Trump said in an interview with Fox News aired on Thursday evening that he would rather not have to use tariffs over China, adding that he thought he could reach a trade deal with the world’s second-largest economy.

Trump’s remarks come just days before the Fed’s first policy meeting to be held during his administration, with very broad expectations officials will leave rates unchanged.

In the broader market, the US dollar was headed for its worst weekly fall in two months, after Trump’s widely expected tariff announcements did not materialise following his inauguration, unlike what he had threatened during his campaign.

The greenback was set to lose 1.4% against a basket of currencies, its steepest decline since November.

The US dollar index was last 0.23% lower at 107.89 on Friday.

Oil prices, a key indicator of currency parity, were little changed on Friday but headed for a weekly decline after US President Donald Trump issued a sweeping plan to boost US production and demanded OPEC lower crude prices.

Brent crude futures were up 6 cents at $78.35 a barrel at 0745 GMT, while US West Texas Intermediate crude (WTI) was 4 cents higher at $74.66.

For the week, Brent is down 3.07% so far, and WTI is down 4.17%.

Inter-bank market rates for dollar on Friday

BID Rs 278.75

OFFER Rs 278.95

Open-market movement

In the open market, the PKR gained 12 paise for buying and lost 8 paise for selling against USD, closing at 279.22 and 281.21, respectively.

Against Euro, the PKR lost 1.56 rupee for buying and 1.42 rupee for selling, closing at 290.92 and 294.28, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 75.96 and 76.55, respectively.

Against Saudi Riyal, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 74.24 and 74.80, respectively.

Open-market rates for dollar on Friday

BID Rs 279.22

OFFER Rs 281.21