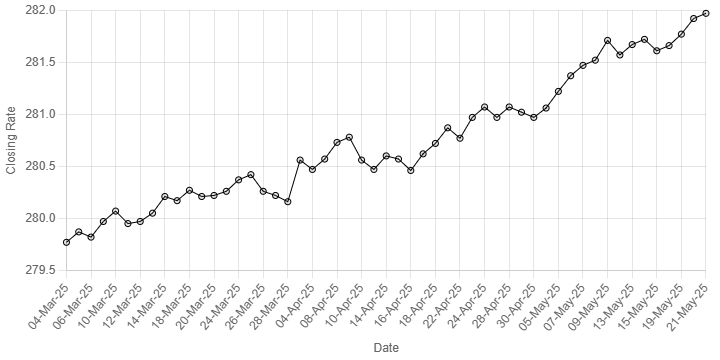

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee slipped lower against the US dollar, depreciating 0.02% in the inter-bank market on Wednesday.

At close, the local currency settled at 281.97, a loss of Re0.05 against the greenback.

On Tuesday, the Pakistani rupee closed the day at 281.92.

Internationally, the US dollar edged lower on Wednesday, extending a two-day slide against major peers, as President Donald Trump failed to convince Republican holdouts to back his sweeping tax bill.

Traders were also wary of US officials potentially angling for a weaker dollar at Group of Seven finance minister meetings currently underway in Canada.

Developments in Trump’s global tariff war, which have swung currencies wildly in recent months, have slowed considerably this week, even as the clock ticks down to the end of 90-day tariff respites for US trade partners in the absence of new trade deals.

While markets remain optimistic that the White House is eager to get trade flowing again on a sustained basis, talks with close allies Tokyo and Seoul appear to have lost momentum recently.

The US dollar declined 0.14% to 144.31 yen early in Asia’s day, and slipped 0.22% to 0.8264 Swiss franc.

Oil prices, a key indicator of currency parity, gained more than 1% on Wednesday after reports of Israel preparing a strike on Iranian nuclear facilities raised fears that a conflict could upset supply availability in the key Middle East producing region.

Brent futures for July rose 68 cents, or 1.04%, to $66.06 a barrel, by 0630 GMT.

US West Texas Intermediate crude futures for July climbed 70 cents, or 1.1%, to $62.73.