Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”, “13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”, “11-Nov-25”, “12-Nov-25”, “13-Nov-25”, “14-Nov-25”, “17-Nov-25”, “18-Nov-25”, “19-Nov-25”, “20-Nov-25”, “21-Nov-25”, “24-Nov-25”, “25-Nov-25”, “26-Nov-25”, “27-Nov-25”, “28-Nov-25”, “01-Dec-25”, “02-Dec-25”, “03-Dec-25”, “04-Dec-25”, “05-Dec-25”, “08-Dec-25”, “09-Dec-25”, “10-Dec-25”, “11-Dec-25”, “12-Dec-25”, “15-Dec-25”, “16-Dec-25”, “17-Dec-25”, “18-Dec-25”, “19-Dec-25”, “22-Dec-25”, “23-Dec-25”, “24-Dec-25”, “26-Dec-25”, “29-Dec-25”, “30-Dec-25”, “31-Dec-25”, “02-Jan-26”, “05-Jan-26”, “06-Jan-26”, “07-Jan-26”, “08-Jan-26”, “09-Jan-26”, “12-Jan-26”, “13-Jan-26”, “14-Jan-26”, “15-Jan-26”, “16-Jan-26”, “19-Jan-26”, “20-Jan-26”, “21-Jan-26”, “22-Jan-26”, “23-Jan-26”, “26-Jan-26”, “27-Jan-26”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81, 280.78, 280.77, 280.76, 280.72, 280.71, 280.67, 280.66, 280.66, 280.65, 280.62, 280.61, 280.57, 280.56, 280.55, 280.52, 280.51, 280.47, 280.46, 280.45, 280.42, 280.41, 280.40, 280.37, 280.36, 280.32, 280.31, 280.30, 280.27, 280.26, 280.25, 280.22, 280.21, 280.20, 280.17, 280.16, 280.15, 280.12, 280.11, 280.10, 280.07, 280.06, 280.05, 280.02, 280.01, 280.0, 279.97, 279.96, 279.95, 279.92, 279.91, 279.90, 279.87, 279.86, 279.85, 279.82

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

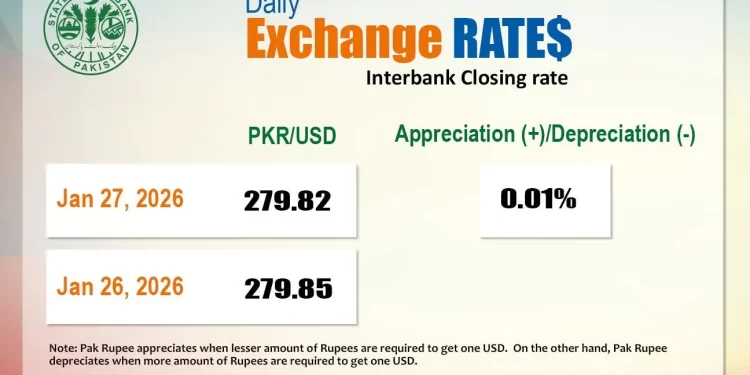

The Pakistani rupee registered marginal improvement, appreciating 0.01% against the US dollar in the inter-bank market on Tuesday.

At close, the local currency settled at 279.82, a gain of Re0.03 against the greenback.

On Monday, the local unit closed at 279.85.

Pakistan’s inflation was projected to remain within the range of 5-6% in January 2026, the Finance Division said on Tuesday. In its Monthly Economic Update & Outlook January 2026, it said Pakistan’s economy was well positioned to sustain its growth momentum in FY2026, “supported by the encouraging performance of LSM [large-scale manufacturing] and other high-frequency indicators”.

Internationally, the US dollar edged higher on Tuesday but struggled to gain momentum, while traders remained on the alert for potential coordinated currency intervention by authorities in the United States and Japan and looked to Wednesday’s Federal Reserve interest rate decision.

Much of the recent focus in the foreign exchange market has been on the yen, which has rallied as much as 3% over the past two sessions on talk of the US and Japan conducting rate checks – often seen as a precursor to official intervention.

That has helped the yen steady around 153 to 154 per dollar, some distance away from Friday’s low of 159.23. It was last trading at 154.75, with the dollar gaining around 0.4% against the yen.

The US dollar has been under intense pressure from a range of factors, including Washington’s desire for a weaker currency and uncertainty over US President Donald Trump’s policymaking.

The dollar rose for the first time in four days against a basket of currencies, climbing 0.2% to 97.27. It has fallen around 1% since the start of the year, and hit a four-month low of 96.808 on Monday.

Oil prices, a key indicator of currency parity, jumped over 1% on Tuesday as a massive winter storm hit crude production and affected refineries on the US Gulf Coast, with the market also finding support from the slow restart of output from the Tengiz oilfield in Kazakhstan.

Brent crude futures were up 90 cents or 1.4%, at $66.49 a barrel by 1415 GMT. US West Texas Intermediate crude was up 87 cents or 1.4%, at $61.50 a barrel.

Inter-bank market rates for dollar on Tuesday

BID Rs 279.82

OFFER Rs 280.02

Open-market movement

In the open market, the PKR lost 3 paise for buying and gained 6 paise for selling against USD, closing at 280.28 and 280.90, respectively.

Against Euro, the PKR lost 55 paise for buying and 44 paise for selling, closing at 332.52 and 335.59, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and 1 paisa for selling, closing at 76.55 and 77.30, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and 3 paise for selling, closing at 74.82 and 75.43, respectively.

Open-market rates for dollar on Tuesday

BID Rs 280.28

OFFER Rs 280.90