The Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Thursday.

At close, the local unit settled at 278.4, a loss of Re0.14 against the greenback, as per the State Bank of Pakistan (SBP).

On Wednesday, the rupee closed at 278.26, down by Re0.08.

In a key development, well-informed sources in CPPA-G told media that Power Division has reportedly obtained Prime Minister’s approval to further enhance electricity tariff, i.e., up to 10% of the total cost and reduction of variable charges to ensure tariff remains neutral for end consumers, besides recovery of taxes from relevant segments instead of through electricity bills and winding up the poorly performing NTDC.

Globally, the US dollar skidded to multi-month lows on Thursday after US core inflation hit its slowest in three years and retail sales turned flat, which pulled forward expectations for rate cuts in the world’s biggest economy.

Core US inflation slowed to an annualised 3.6% in April, Wednesday’s data showed, in line with market expectations.

That is well above the Federal Reserve’s 2% goal, but since it eased from 3.8% a month earlier investors saw it as opening the way for a rate cut as soon as September or perhaps even earlier, as the US presidential election looms in November.

The US dollar index made its heaviest one-day percentage drop for the year so far overnight, falling 0.75% and through its 200-day moving average.

Oil prices, a key indicator of currency parity, held steady on Thursday, bolstered by signs of stronger demand in the US after slower than expected inflation in April and lower oil stocks in the past week. Brent crude futures fell 25 cents, or 0.3%, to $82.50 a barrel by 0951 GMT.

US West Texas Intermediate crude (WTI) shed 26 cents, or 0.33%, to $78.37.

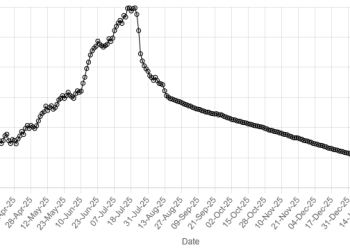

American Dollar Exchange Rate

American Dollar Exchange Rate