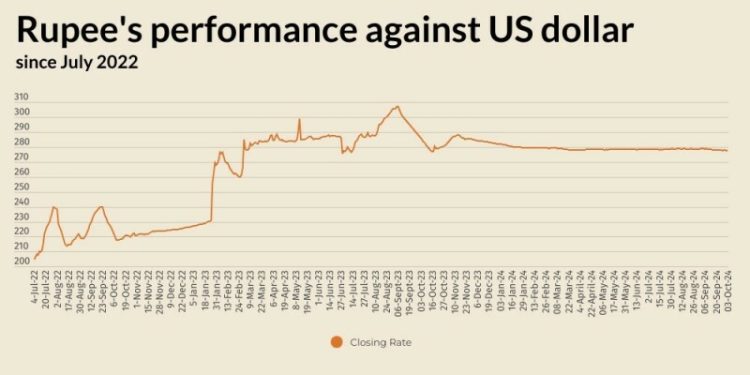

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.03% against the US dollar in the inter-bank market on Thursday.

At close, the currency settled at 277.74, a loss of Re0.10 against the greenback.

On Wednesday, the rupee had settled at 277.64, according to the State Bank of Pakistan (SBP).

Globally, the US dollar rose to a one-month high versus the yen on Thursday as robustness in the US jobs market backed the idea that the Federal Reserve does not need to rush to cut interest rates.

The safe-haven US currency saw some additional demand on Wednesday after Iran launched a salvo of some 180 ballistic missiles into Israel, spurring a vow of retaliation and stoking worries of all-out war.

The dollar index, which measures the currency against the euro, yen and four other top rivals, ticked up to 101.70 as of 0023 GMT, a three-week high, extending a 0.45% climb from the previous session.

Currently, traders lay 34.6% odds of another 50 basis-point US rate cut on November 7, after the Fed kicked off its easing cycle with a super-sized reduction last month.

That’s down from 36.8% odds a day earlier, and 57.4% odds a week ago, according to the CME Group’s FedWatch Tool, but still seems too high, according to Ray Attrill, head of FX strategy at National Australia Bank.

Oil prices, a key indicator of currency parity, rose on Thursday as the prospect of a widening Middle East conflict that could disrupt crude oil flows from the region overshadowed a stronger global supply outlook.

Brent crude futures were up $1.02, or 1.38%, to $74.92 a barrel at 0840 GMT. US West Texas Intermediate crude futures were up $1.10, or 1.57%, to $71.20.