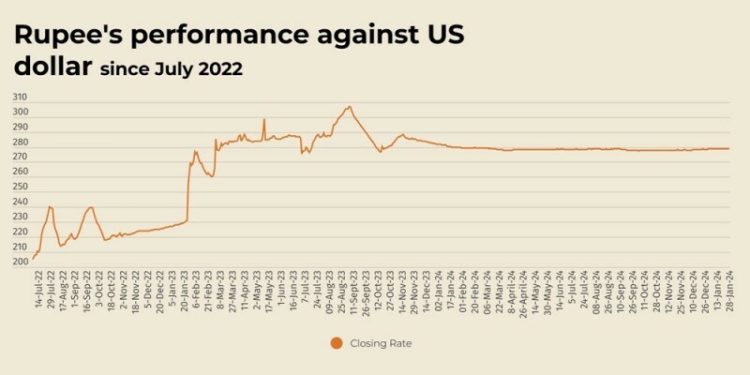

The Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Tuesday.

At close, the currency settled at 278.93 for a loss of Re0.10 against the greenback.

According to the State Bank of Pakistan (SBP), the rupee closed at 278.83 on Monday.

Internationally, the Japanese yen gave up some of the safe-haven driven gains on Tuesday as investors grappled with the potential implications of a Chinese startup’s free open-source artificial intelligence model, while fresh tariff threats had the euro on the back foot.

The US dollar steadied after it took a hit overnight amid a broad shakeout in financial markets due to the emergence of China’s DeepSeek free AI assistant, which it says uses lower-cost chips and less data.

The new AI model threatens to upend widespread bets that in the past have lifted shares of US technology stocks, especially chipmaker Nvidia, triggering a sell-off in shares in a broad risk-off move.

The US dollar was up 0.7% against the yen at 155.70, putting the currency pair back within its recent trading range after the yen strengthened to its strongest level since mid-December at 153.715 on Monday amid the safe-haven bids.

The euro fetched $1.0428, down 0.6% ahead of the European Central Bank policy meeting this week that is expected to cut interest rates as US President Donald Trump talked up the threat of tariffs.

Trump said he plans to impose tariffs on imported computer chips, pharmaceuticals and steel to get the producers to make them in the United States.

The dollar index, which measures the US currency against six rivals the yen and the euro, rose 0.13% to 107.94, after dropping to its lowest level since mid-December on Monday at 107.68.

Oil prices, a key indicator of currency parity, ticked up but hovered near a two-week low on Tuesday after weak economic data from China and warming weather forecasts elsewhere soured the demand outlook.

Brent crude oil futures rose by 60 cents, or 0.78%, to $77.68 per barrel by 0730 GMT.

US West Texas Intermediate crude futures were up 50 cents, or 0.68%, to $73.67.

Brent settled on Monday at its lowest since January 9, while WTI hit its lowest since January 2.

American Dollar Exchange Rate

American Dollar Exchange Rate