The Pakistani rupee registered a marginal decline, depreciating 0.03% against the US dollar in the inter-bank market on Wednesday.

At close, the currency settled at 278.74, a loss of Re0.08, against the greenback.

On Tuesday, the currency had settled at 278.66 against the US dollar.

In recent months, the domestic currency has largely been around 277-279 against the dollar as traders have an eye on some strong positive indicators.

Globally, the yen hovered near a 2-1/2-month high against the US dollar on Wednesday ahead of a key Bank of Japan (BOJ) policy decision where the central bank is set to detail plans to taper its huge bond buying and a rate hike is on the cards.

The dollar index was little changed at 104.46, and was on track to lose 1.3% for the month. Traders were closely watching the Fed’s policy decision later on Wednesday – likely to be the next main catalyst for broad currency moves after the BOJ – where expectations are for policymakers to lay the groundwork for a September rate cut.

Markets are expecting a September start to the Fed’s easing cycle, with about 68 basis points worth of cuts priced in for the rest of the year.

Expectations of imminent Fed cuts have halted the dollar’s advance, after decades-high US rates bolstered the greenback’s appeal for the most part of the past two years.

Oil prices, a key indicator of currency parity, climbed on Wednesday, rebounding from 7-week lows, as the killing of a Hamas leader in Iran ratcheted up tensions in the Middle East and overshadowed concerns about weak China demand.

Brent crude futures climbed $1.80, or 2.29%, to $80.43 a barrel by 1038 GMT ahead of expiry on Wednesday, while the more active October contract was up $1.85 at $79.92.

US West Texas Intermediate crude futures were up $2, or 2.68%, to $76.73 a barrel. A 0.4% fall in the US dollar index also lent support to prices.

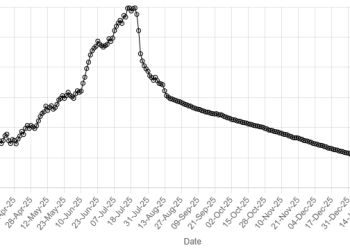

American Dollar Exchange Rate

American Dollar Exchange Rate