The Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Friday.

At close, the local currency settled at 279.56, a gain of Re0.01 against the greenback.

The State Bank of Pakistan was closed on January 19 (Thursday) on account of the first day of Ramazan.

On Wednesday, the local currency closed at 279.57, according to the State Bank of Pakistan (SBP).

Earlier, the International Monetary Fund (IMF) said Pakistan’s reform efforts under its programme have helped stabilise the economy and rebuild confidence, citing improved fiscal discipline and stronger external accounts.

“Pakistan’s policy efforts under the EFF (Extended Fund Facility) have helped stabilise the economy and rebuild confidence,” said IMF Director of Communications, Julie Kozack, while responding to a question.

Meanwhile, the dollar was poised on Friday to cap its strongest weekly performance since October, buoyed by a run of better-than-expected economic data, a more hawkish Federal Reserve outlook and as tensions between the U.S. and Iran kept markets on edge.

Overnight, the greenback got an added lift after data showed the number of Americans filing new applications for unemployment benefits fell more than expected last week, underscoring labour market stability.

It clung to gains in early Asia trade on Friday and left sterling languishing near a one-month low at $1.3457. It was headed for a weekly drop of nearly 1.5%.

The euro was similarly down a touch 0.02% at $1.1768 and set to lose 0.8% for the week, with the common currency also weighed down by uncertainty over European Central Bank President Christine Lagarde’s tenure.

Against a basket of currencies, the dollar hovered near Thursday’s one-month peak and was last at 97.89. It was on track for a weekly gain of more than 1%, which would mark its strongest performance in more than four months.

Moreover, oil prices hovered near six-month highs on Friday, headed for their first weekly gain in three on growing concerns a conflict may erupt after Washington said Tehran will suffer if it does not agree a deal on its nuclear activity in a matter of days.

Brent crude futures edged down 19 cents, or 0.3%, to $71.47, while US West Texas Intermediate crude declined by 13 cents, or 0.2%, to $66.30 as of 0900 GMT.

For the week, Brent was up 5.5% and WTI gained 5.4% so far.

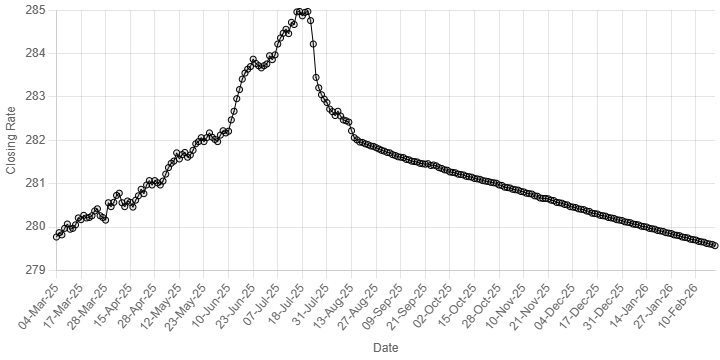

American Dollar Exchange Rate

American Dollar Exchange Rate