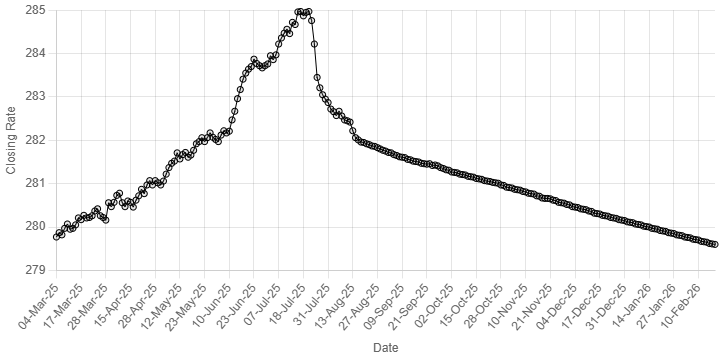

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal gain against the US dollar, appreciaiting 0.01% in the inter-bank market on Wednesday.

At close, the local currency settled at 279.57, a gain of Re0.03 against the greenback.

On Tuesday, the local currency closed at 279.60, according to the State Bank of Pakistan (SBP).

Meanwhile, the dollar held its ground on Wednesday as geopolitical risks kept markets on edge and investors awaited minutes from the Federal Reserve for signals on future rate cuts.

The yen was steady after data showing a rebound in Japanese manufacturer sentiment and President Donald Trump announced the first tranche of mega-investments Tokyo is making in the US.

The dollar index, which measures the greenback against a basket of currencies, was little changed at 97.16 after a two-day advance. The euro slid 0.06% to $1.1846.

The yen held steady at 153.23 per dollar, and sterling weakened 0.07% to $1.3558, after a 0.5% slide in the previous session.

Oil prices gained nearly 3% on Wednesday after peace talks between Ukraine and Russia in Geneva ended after only two hours and as investor concerns persisted about the prospect of conflict between the US and Iran.

The US-mediated talks over Ukraine in Switzerland took place as US President Donald Trump has twice in recent days suggested it was up to Ukraine to take steps to ensure their success. President Volodymyr Zelenskiy described them as “difficult.”

Brent crude oil futures were up $1.96, or 2.9%, to $69.38 a barrel at 1440 GMT, while US West Texas Intermediate (WTI) crude gained $1.75, or 2.8%, to $64.08. Both contracts fell to two-week lows on Tuesday.

Inter-bank market rates for dollar on Wednesday

BID Rs 279.57

OFFER Rs 279.77

Open-market movement

In the open market, the PKR gained 3 paise for buying and 4 paise for selling against USD, closing at 280.07 and 280.62, respectively.

Against Euro, the PKR gained 11 paise for buying and 16 paise for selling, closing at 331.11 and 333.97, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and lost 1 paisa for selling, closing at 76.45 and 77.21, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and lost 1 paisa for selling, closing at 74.73 and 75.34, respectively.

Open-market rates for dollar on Wednesday

BID Rs 280.07

OFFER Rs 280.62

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal gain against the US dollar, appreciaiting 0.01% in the inter-bank market on Wednesday.

At close, the local currency settled at 279.57, a gain of Re0.03 against the greenback.

On Tuesday, the local currency closed at 279.60, according to the State Bank of Pakistan (SBP).

Meanwhile, the dollar held its ground on Wednesday as geopolitical risks kept markets on edge and investors awaited minutes from the Federal Reserve for signals on future rate cuts.

The yen was steady after data showing a rebound in Japanese manufacturer sentiment and President Donald Trump announced the first tranche of mega-investments Tokyo is making in the US.

The dollar index, which measures the greenback against a basket of currencies, was little changed at 97.16 after a two-day advance. The euro slid 0.06% to $1.1846.

The yen held steady at 153.23 per dollar, and sterling weakened 0.07% to $1.3558, after a 0.5% slide in the previous session.

Oil prices gained nearly 3% on Wednesday after peace talks between Ukraine and Russia in Geneva ended after only two hours and as investor concerns persisted about the prospect of conflict between the US and Iran.

The US-mediated talks over Ukraine in Switzerland took place as US President Donald Trump has twice in recent days suggested it was up to Ukraine to take steps to ensure their success. President Volodymyr Zelenskiy described them as “difficult.”

Brent crude oil futures were up $1.96, or 2.9%, to $69.38 a barrel at 1440 GMT, while US West Texas Intermediate (WTI) crude gained $1.75, or 2.8%, to $64.08. Both contracts fell to two-week lows on Tuesday.

Inter-bank market rates for dollar on Wednesday

BID Rs 279.57

OFFER Rs 279.77

Open-market movement

In the open market, the PKR gained 3 paise for buying and 4 paise for selling against USD, closing at 280.07 and 280.62, respectively.

Against Euro, the PKR gained 11 paise for buying and 16 paise for selling, closing at 331.11 and 333.97, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and lost 1 paisa for selling, closing at 76.45 and 77.21, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and lost 1 paisa for selling, closing at 74.73 and 75.34, respectively.

Open-market rates for dollar on Wednesday

BID Rs 280.07

OFFER Rs 280.62