The Pakistani rupee registered minor improvement, appreciating 0.04% against the US dollar in the inter-bank market on Tuesday.

At close, the currency settled at 278.34, a gain of Re0.10 against the US dollar.

On Monday, the rupee had settled at 278.44 against the greenback, according to the State Bank of Pakistan (SBP).

In recent months, the domestic currency has largely been around 277-279 against the dollar as traders keep an eye on some strong positive indicators.

Meanwhile, the final approval of Pakistan’s much-anticipated $7 billion bailout package from the International Monetary Fund (IMF) remains uncertain, as the IMF Executive Board’s schedule until August 28 has been released.

Notably, Pakistan’s name has yet to be included in the board’s agenda, raising concerns about the timeline for the disbursement of the loan.

Globally, the US dollar wobbled near a seven-month low on Tuesday on wagers the US central bank will start cutting interest rates from next month, with traders bracing for comments from Federal Reserve Chair Jerome Powell on Friday.

The focus this week will be on Powell’s speech in Jackson Hole, likely keeping investors hesitant in placing major bets before the event. Minutes of the Fed’s last meeting due to be released on Wednesday will also be in the spotlight.

Investors largely expect Powell to acknowledge the case for a rate cut and will parse his words for cues on whether the Fed will start with a 25 basis point cut or a 50 bps cut in September.

Markets are pricing in a 24.5% chance of a 50 bps cut in September, down from 50% a week ago, with a 25-basis-point reduction having odds of 75.5%, the CME FedWatch Tool showed. Traders are pricing in a total of 93 bps of cuts this year.

The dollar index, which measures the US currency against six rivals, was last at 101.95 after touching its lowest since Jan. 2 of 101.82 earlier on Tuesday. The index is down more than 2% in August and set for a second month in the red.

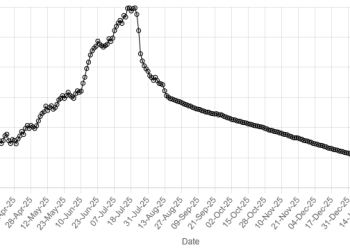

American Dollar Exchange Rate

American Dollar Exchange Rate