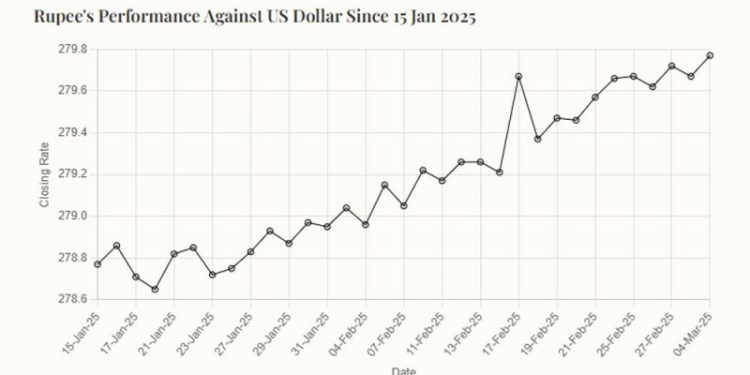

Rupee’s Performance Against US Dollar Since 15 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“15-Jan-25”, “16-Jan-25”, “17-Jan-25”, “20-Jan-25”, “21-Jan-25”, “22-Jan-25”, “23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”, “28-Feb-25”, “04-Mar-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.77, 278.86, 278.71, 278.65, 278.82, 278.85, 278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72, 279.67, 279.77

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee recorded marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Tuesday.

At close, the rupee settled at 279.77, a loss of Re0.10 against the greenback.

During the previous week, the rupee depreciated further against the US dollar as it lost Re0.10 or 0.4% in the inter-bank market.

The local unit closed at 279.67, against 279.57 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

The currency market was closed on Monday on account of a bank holiday.

Internationally, the US dollar remained depressed, with the sterling holding close to a 1 1/2-month high, and the euro also remained firm as European leaders drew up a Ukraine peace plan to present to Washington.

Investors turned sharply more risk-averse after US President Donald Trump said 25% tariffs on Canada and Mexico will go into effect from 0501 GMT on Tuesday, along with a doubling of China levies to 20%.

The Canadian dollar and Mexican peso tumbled, although China’s yuan bounced off its lowest level since February 13 in offshore trading.

Investors were also concerned about the fallout for the US economy as well, particularly amid a run of soft data in recent weeks.

Those worries escalated on Monday with figures showing factory gate prices jumped to a nearly three-year high and materials deliveries took longer, suggesting that tariffs on imports could soon hamper production.

Many investors and analysts remained optimistic though in the medium term.

Oil prices, a key indicator of currency parity, extended losses on Tuesday following reports that OPEC+ will proceed with a planned output increase in April while markets braced for US tariffs on Canada, Mexico and China to take effect.

Brent futures fell 49 cents, or 0.7%, to $71.13 a barrel at 0455 GMT, as US West Texas Intermediate (WTI) crude eased 26 cents, or 0.4%, to $68.11.

Inter-bank market rates for dollar on Tuesday

BID Rs279.80

OFFER Rs280.00

Open-market movement

In the open market, the PKR gained 90 paise for buying and lost 8 paise for selling against USD, closing at 279.09 and 281.30, respectively.

Against Euro, the PKR lost 2.40 rupees for buying and 2.49 rupees for selling, closing at 292.64 and 295.51, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and 1 paisa for selling, closing at 76.05 and 76.60, respectively.

Against Saudi Riyal, the PKR lost 10 paise for buying and 12 paise for selling, closing at 74.41 and 74.96, respectively.

Open-market rates for dollar on Tuesday

BID Rs279.09

OFFER Rs281.30