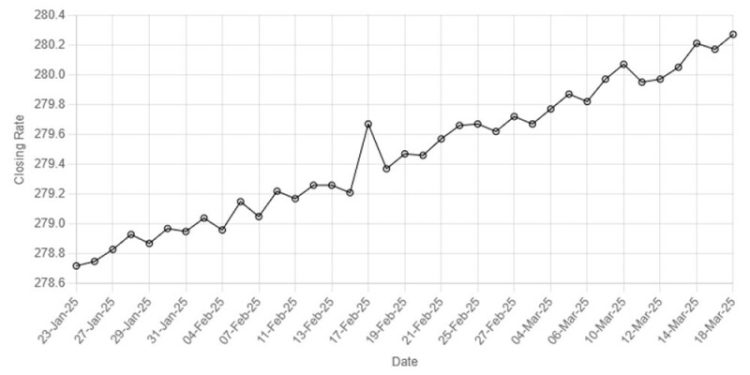

Rupee’s Performance Against US Dollar Since 23 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”, “28-Feb-25”, “04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”, “13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72, 279.67, 279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Tuesday.

At close, the currency settled at 280.27, a fall of Re0.10 against the greenback.

On Monday, the rupee had closed at 280.17.

Internationally, the US dollar wallowed near a five-month trough against the euro and other major peers on Tuesday as investors grappled with the potential economic impact of growing global trade tensions.

Fears that US President Donald Trump’s aggressive tariff policies could trigger a broader economic slowdown has undermined the greenback amid a string of soggy sentiment surveys.

The US dollar index, which measures the currency against six key rivals, has dropped around 6% from the more than two-year peak of 110.17 hit in mid-January.

It was last at 103.44, struggling to make a decisive move away from a five-month low of 103.21 touched last Tuesday.

The US currency hardly got much support from retail sales data on Monday that showed a modest rebound in February after a revised 1.2% decline in January.

The Fed will also publish new economic projections, which will provide the most tangible evidence yet of how US central bankers view the likely impact of the Trump administration’s policies on the economy.

Oil prices, a key indicator of currency parity, edged higher on Tuesday, supported by instability in the Middle East as well as China’s plans for more economic stimulus, though global growth concerns, US tariffs and uncertainty over Ukraine ceasefire talks curbed gains.

Brent futures rose 36 cents, or 0.5%, to $71.43 a barrel by 0700 GMT, while US West Texas Intermediate crude futures rose 32 cents, or 0.5%, to $67.90.

American Dollar Exchange Rate

American Dollar Exchange Rate