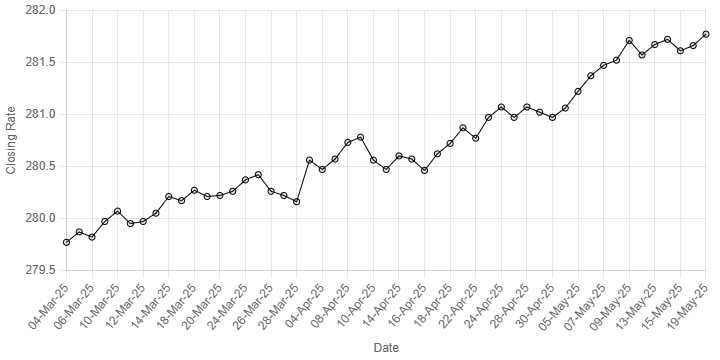

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Monday.

At close, the local currency settled at 281.77, a loss of Re0.11 against the greenback.

During the previous week, the rupee posted a marginal gain against the US dollar as it appreciated by Re0.05 or 0.02% in the inter-bank market.

The local unit closed at 281.66, against 281.71 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar trimmed a four-week gain in early Asian trade as markets digested a surprise downgrade of the US government’s credit rating and as lingering trade frictions weighed on sentiment.

The greenback advanced 0.6% against major counterparts last week after a temporary trade truce between the United States and China eased fears of a global recession. But economic data pointed to rising import prices and waning consumer confidence.

Moody’s cut America’s top sovereign credit rating by one notch on Friday, the last of the major ratings agencies to downgrade the country, citing concerns about the nation’s growing $36 trillion debt pile.

US Treasury Secretary Scott Bessent said in television interviews on Sunday that President Donald Trump will impose tariffs at the rate he threatened last month on trading partners that do not negotiate in “good faith.”

Meanwhile, Trump is facing resistance within his own party in pushing forward a sweeping tax cut bill that would add an estimated $3 trillion to $5 trillion to the nation’s debt over the next decade.

The US dollar lost 0.3% to 145.22 yen.

The greenback was also 0.2% lower against the Swiss franc, another safe-haven counterpart.

Oil prices, a key indicator of currency parity, slipped on Monday, weighed down by Moody’s downgrade of the US sovereign credit rating and official data that showed a slowdown in the pace of China’s industrial output and retail sales.

Front-month Brent crude futures edged down 51 cents, or 0.8%, to $64.90 a barrel by 0630 GMT while US West Texas Intermediate crude dropped 45 cents, or 0.7%, to $62.04 a barrel.

The front-month June WTI contract expires on Tuesday and the more-active July contract fell 48 cents, or 0.8%, to $61.49 a barrel.

Both contracts rose more than 1% last week after the US and China, the world’s two biggest economies and oil consumers, agreed to a 90-day pause on their trade war with sharply lower import tariffs.

Inter-bank market rates for dollar on Monday

BID Rs 281.77

OFFER Rs 281.96

Open-market movement

In the open market, the PKR lost 10 paise for buying and 5 paise for selling against USD, closing at 282.75 and 283.80, respectively.

Against Euro, the PKR lost 1.04 rupee for buying and 1.67 rupee for selling, closing at 317.00 and 320.23, respectively.

Against UAE Dirham, the PKR lost 6 paise for buying and 5 paise for selling, closing at 77.05 and 77.50, respectively.

Against Saudi Riyal, the PKR lost 9 paise for buying and 10 paise for selling, closing at 75.35 and 75.80, respectively.

Open-market rates for dollar on Monday

BID Rs 282.75

OFFER Rs 283.80