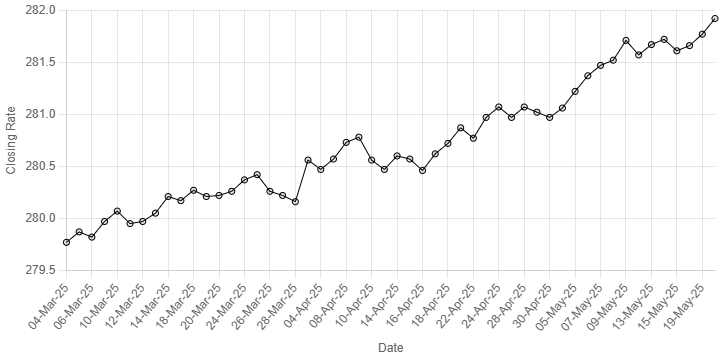

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee slipped lower against the US dollar, depreciating 0.05% in the inter-bank market on Tuesday.

At close, the local currency settled at 281.92, a loss of Re0.15 against the greenback.

On Monday, the Pakistani rupee closed the day at 281.77

Globally, the US dollar traded sideways on Tuesday after having glided lower for a week, hemmed in by the Fed’s caution over the economy and as US lawmakers came closer to passing a bill expected to widen the nation’s fiscal deficit.

The greenback sold off broadly on Monday following last week’s surprise downgrade of the US sovereign rating by Moody’s on deficit concerns. Now, attention turns to a critical vote in Washington over US President Donald Trump’s sweeping tax cuts.

The Australian dollar held most of its gains ahead of the Reserve Bank of Australia’s decision later Tuesday, when it is widely expected to cut interest rates by 25 basis points.

Atlanta Fed President Raphael Bostic told CNBC on Monday that the central bank may only be able to cut interest rates by a quarter point over the rest of the year, given concerns about rising inflation stoked by higher import taxes.

Trump is expected to join the congressional debate over his tax bill on Tuesday. The vote comes after Moody’s stripped the US government of its top-tier credit rating, citing concerns over the nation’s growing $36.2 trillion debt pile.

Trump’s bill would add $3 trillion to $5 trillion to the debt, according to nonpartisan analysts. Trade-related uncertainties, ballooning fiscal debt and weakened confidence about enduring US exceptionalism have weighed on US assets.

The US dollar index has tumbled as much as 10.6% from its January highs, one of the sharpest retreats for a three-month period.

Oil prices, a key indicator of currency parity, barely moved on Tuesday as traders weighed the impact on supply from a possible breakdown in US-Iran talks on Tehran’s nuclear programme, strong front-month physical demand in Asia and a cautious outlook for China’s macro economy.

Brent futures dipped 6 cents to $65.48 a barrel by 0305 GMT.

US West Texas Intermediate crude futures gained 1 cent to $62.7.

Discussions on Iran’s nuclear programme would “lead nowhere” if Washington insisted that Tehran slash uranium enrichment activity entirely, state media quoted Deputy Foreign Minister Majid Takhtravanchi as saying on Monday.

Inter-bank market rates for dollar on Tuesday

BID Rs 281.92

OFFER Rs 282.11

Open-market movement

In the open market, the PKR lost 9 paise for buying and 19 paise for selling against USD, closing at 282.84 and 283.99, respectively.

Against Euro, the PKR lost 77 paise for buying and 13 paise for selling, closing at 317.77 and 320.36, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 77.06 and 77.50, respectively.

Against Saudi Riyal, the PKR lost 3 paise for buying and remained unchanged for selling, closing at 75.38 and 75.80, respectively.

Open-market rates for dollar on Tuesday

BID Rs 282.84

OFFER Rs 283.99

American Dollar Exchange Rate

American Dollar Exchange Rate