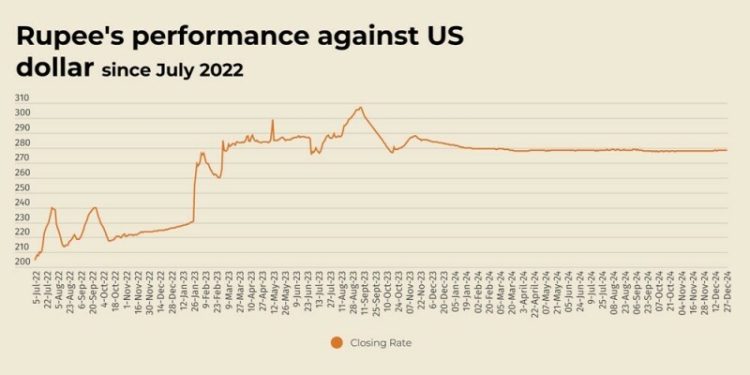

The Pakistani rupee registered marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Friday.

At close, the currency settled at 278.47 for a loss of Re0.10 against the greenback.

The rupee settled at 278.37 on Thursday, according to the State Bank of Pakistan (SBP).

Internationally, the Japanese yen hovered near a five-month low to the US dollar on Friday as the US Federal Reserve’s hawkish messaging contrasted with the Bank of Japan’s cautious approach to further policy tightening.

The yen traded at 157.725 per US dollar as of 0030 GMT, edging up 0.1% from Thursday, but still close to the low of that session at 158.09 per dollar, the yen’s weakest level since July 17.

The US dollar index, which measures the currency against the yen, euro, Sterling and three other major rivals, was steady at 108.09 and has been essentially in a holding pattern around that level all week. For the month, it is up 2.2%.

Many traders are on holiday around Christmas and the New Year.

Leading cryptocurrency bitcoin was steady at $95,660, slipping 1.2% this month, but after touching a record high of 108,379.28 on Dec. 17. It has surged about 125% so far this year.

Oil prices, a key indicator of currency parity, rose slightly on Friday and were on track for a weekly rise, spurred by expectations economic stimulus efforts will prompt a recovery in China, while a stronger dollar capped gains.

Brent crude futures rose 14 cents to $73.40 a barrel by 0750 GMT.

US West Texas Intermediate crude was at $69.79, up 17 cents, from Thursday’s close. On a weekly basis, Brent was up 0.6% and WTI rose 0.5%.

The Pakistani rupee registered marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Friday.

At close, the currency settled at 278.47 for a loss of Re0.10 against the greenback.

The rupee settled at 278.37 on Thursday, according to the State Bank of Pakistan (SBP).

Internationally, the Japanese yen hovered near a five-month low to the US dollar on Friday as the US Federal Reserve’s hawkish messaging contrasted with the Bank of Japan’s cautious approach to further policy tightening.

The yen traded at 157.725 per US dollar as of 0030 GMT, edging up 0.1% from Thursday, but still close to the low of that session at 158.09 per dollar, the yen’s weakest level since July 17.

The US dollar index, which measures the currency against the yen, euro, Sterling and three other major rivals, was steady at 108.09 and has been essentially in a holding pattern around that level all week. For the month, it is up 2.2%.

Many traders are on holiday around Christmas and the New Year.

Leading cryptocurrency bitcoin was steady at $95,660, slipping 1.2% this month, but after touching a record high of 108,379.28 on Dec. 17. It has surged about 125% so far this year.

Oil prices, a key indicator of currency parity, rose slightly on Friday and were on track for a weekly rise, spurred by expectations economic stimulus efforts will prompt a recovery in China, while a stronger dollar capped gains.

Brent crude futures rose 14 cents to $73.40 a barrel by 0750 GMT.

US West Texas Intermediate crude was at $69.79, up 17 cents, from Thursday’s close. On a weekly basis, Brent was up 0.6% and WTI rose 0.5%.