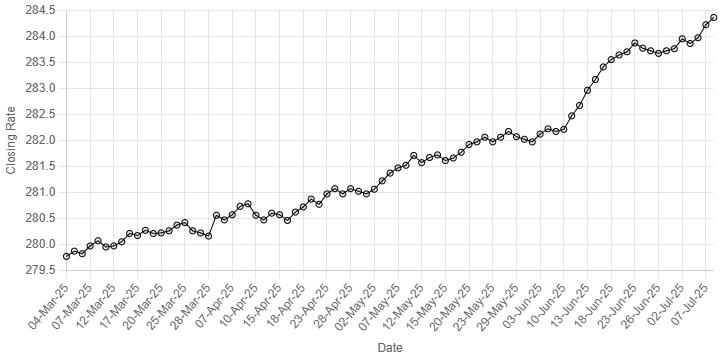

Rupee’s Performance Against US Dollar Since 04 March 2025

Pakistani rupee weakened further against the US dollar, depreciating 0.05% in the inter-bank market on Wednesday.

At close, the currency settled at 284.36, registering a decline of Re0.14.

On Monday, the currency settled at 284.22.

Internationally, the Japanese yen fell broadly on Tuesday while the US dollar held steady as US President Donald Trump unveiled 25% tariffs on goods from Japan and South Korea in the latest development of his chaotic trade war.

Trump on Monday began telling trade partners – from powerhouse suppliers like Japan and South Korea to minor players – that sharply higher US tariffs will start August 1.

He later said that he was open to extensions if countries made proposals.

The announcement rattled investor sentiment, sending the Japanese yen and South Korean won down roughly 1% overnight.

Both currencies remained under pressure early on Tuesday, with the yen falling to a two-week low of 146.44 per dollar.

Investors entered the week with much confusion over Trump’s tariff plans ahead of an initial July 9 deadline. While the new August 1 date offers a brief reprieve, the outlook remains uncertain and global economic concerns persist.

Against a basket of currencies, the dollar was little changed at 97.40, holding on to most of its gains from Monday when it rose 0.5%.

Oil prices, a key indicator of currency parity, retreated on Tuesday after rising almost 2% in the previous session as investors assessed new developments on US tariffs and a higher-than-expected OPEC+ output hike for August.

Brent crude futures dipped 22 cents, or 0.3%, at $69.36 a barrel by 0630 GMT.

US West Texas Intermediate crude fell 27 cents, or 0.4%, at $67.66 a barrel.