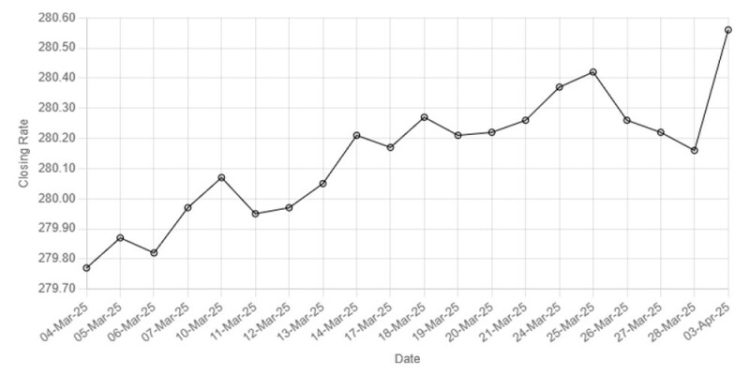

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”,

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal decline against the US dollar, depreciating 0.14% in the inter-bank market on Thursday.

At close, the currency settled at 280.56, a fall of Re0.4 against the greenback.

During the previous week, rupee appreciated marginally against the US dollar as it gained Re0.10 or 0.03% in the inter-bank market. The local unit closed at 280.16, against 280.26 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar slid broadly on Thursday and the euro firmed after President Donald Trump announced more aggressive-than-expected tariffs against US trading partners, jolting the markets as investors sought safe havens such as the yen and Swiss franc.

The highly anticipated tariff announcement sent shockwaves through markets, with global stocks sinking and investors scrambling to the safety of bonds as well as gold.

Trump said he would impose a 10% baseline tariff on all imports to the United States and higher duties on some of the country’s biggest trading partners. The tariffs will take effect on April 9 and appeared to target about 60 countries.

The new levies ratchet up a trade war that Trump kicked off on his return to the White House, rattling markets as fears grow that a full-blown trade war could trigger a sharp global economic slowdown.

Trump has already imposed tariffs on aluminium, steel and autos, as well as increased duties on all goods from China.

The risk-sensitive Australian dollar fell 0.4% to $0.6274, while the New Zealand dollar slipped 0.12% to $0.5738.

The new duties left investors scrambling for shelter in traditional safe havens: the Japanese yen and the Swiss franc. The yen strengthened nearly 1% to 147.99 per dollar, while the Swiss franc was stronger at 0.87815 per dollar.

The dollar index, which compares the US currency against six rivals, was at 103.13, its lowest since mid-October.

Oil prices, a key indicator of currency parity, fell by over 3% on Thursday after US President Donald Trump announced sweeping new tariffs which investors worry will enflame a global trade war that will curtail economic growth and limit fuel demand.

Brent futures were down $2.66, or 3.55%, to $72.29 a barrel by 0918 GMT. US West Texas Intermediate crude futures were down $2.69, or 3.75%, to $69.02.