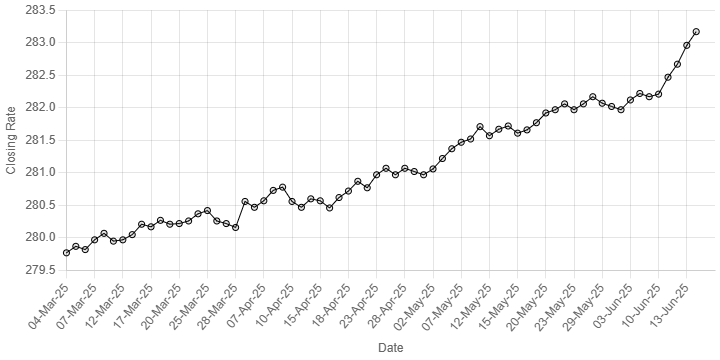

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”,, “17-Jun-25”,

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee registered marginal decline against the US dollar, depreciating 0.08% in the interbank market on Tuesday.

At close, the local currency settled at 283.41, a loss of Re0.24 against the greenback.

On Monday, the local unit closed at 283.17.

Internationally, the US dollar firmed slightly on Tuesday, though most currencies held tight ranges as investors remained spooked by ongoing tensions in the Middle East and awaited upcoming central bank decisions.

The Bank of Japan (BOJ) concludes its two-day monetary policy meeting later on Tuesday, where it is expected to keep interest rates steady and consider slowing reductions in its bond purchases from next fiscal year.

Ahead of the outcome, the yen edged a touch higher to 144.70 per dollar, reversing some of its declines from the previous session.

In the broader market, the dollar extended some of its gains in a general risk-off move as ongoing tensions in the Middle East weighed on sentiment.

The White House said on Monday that Donald Trump is leaving the Group of Seven summit in Canada a day early due to the situation in the Middle East, as the president has requested that the National Security Council be prepared in the situation room.

Trump had earlier urged everyone to immediately evacuate Tehran, and reiterated that Iran should have signed a nuclear deal with the United States.

Against a basket of currencies, the dollar firmed slightly at 98.23.

Oil prices, a key indicator of currency parity, rose on Tuesday, with analysts saying that uncertainty would keep prices elevated, even as there were no concrete signs of any production losses stemming from the Iran-Israel conflict.

Brent crude futures climbed 82 cents, or 1.1%, to $74.05 a barrel as of 0840 GMT.

US West Texas Intermediate crude was up 77 cents, or 1.1%, at $72.54.

Both contracts rose more than 2% earlier in the trading session but also notched declines before bouncing back in volatile trading.

Iran is the third-largest producer among members of the Organization of the Petroleum Exporting Countries and there is widespread concern the fighting could affect exports from there.

Additionally, investors are watching for signs shipments through the Straits of Hormuz, through which flows about 19 million barrels per day of oil and oil products, may be impacted.

Inter-bank market rates for dollar on Tuesday

BID Rs 283.41

OFFER Rs 283.61

Open-market movement

In the open market, the PKR lost 27 paise for buying and 6 paise for

selling against USD, closing at 283.80 and 285.40, respectively.

Against Euro, the PKR lost 14 paise for buying and gained 2 paise for selling, closing at 326.25 and 329.68, respectively.

Against UAE Dirham, the PKR lost 7 paise for buying and 6 paise for

selling, closing at 77.04 and 77.81, respectively.

Against Saudi Riyal, the PKR lost 6 paise for buying and 7 paise for selling, closing at 75.29 and 76.04, respectively.

Open-market rates for dollar on Tuesday

BID Rs 283.80

OFFER Rs 285.40

American Dollar Exchange Rate

American Dollar Exchange Rate