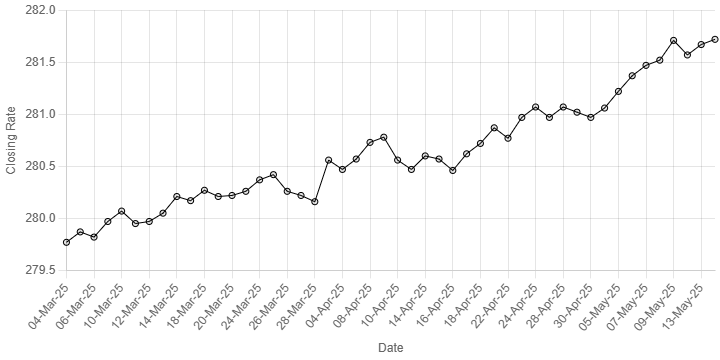

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee weakened further against the US dollar, depreciating 0.02% in the inter-bank market on Wednesday.

At close, the local currency settled at 281.72, a loss of Re0.05 against the greenback.

On Tuesday, the rupee closed the day at 281.67.

Internationally, the US dollar stabilised on Wednesday following its biggest decline in more than three weeks overnight, with softer-than-expected US consumer inflation data bolstering the case for Federal Reserve easing just as global trade tensions cool.

Inflation in US is likely to pick up in the coming months as US tariffs lift the cost of imported goods, although the outlook for US trade has improved following an agreement with Britain last week and weekend talks with China that yielded a 90-day truce in their tit-for-tat tariff war.

US President Donald Trump said earlier this month he has “potential deals” with India, Japan and South Korea.

The US dollar index, which measures the currency against six major peers, was flat at 100.94 as of 0042 GMT, following a 0.8% slide on Tuesday.

The index had jumped 1% on Monday and touched a one-month peak on optimism that a de-escalation in Sino-US trade tensions would avert a potential global recession.

Oil prices, a key indicator of currency parity, retreated on Wednesday as traders eyed a potential jump in US crude inventories, though prices held near two-week highs amid optimism after the United States and China agreed to temporarily lower their reciprocal tariffs.

Brent crude futures fell 39 cents, or 0.6%, to $66.24 a barrel by 0400 GMT.

US West Texas Intermediate (WTI) crude slipped 36 cents, or 0.6%, to $63.31.

Both benchmarks had climbed more than 2.5% in the previous session.

Inter-bank market rates for dollar on Wednesday

BID Rs 281.72

OFFER Rs 281.91

Open-market movement

In the open market, the PKR lost 6 paise for buying and 3 paise for

selling against USD, closing at 282.28 and 283.72, respectively.

Against Euro, the PKR lost 3.40 rupees for buying and 3.70 rupees for selling,

closing at 316.59 and 319.79, respectively.

Against UAE Dirham, the PKR lost 5 paise for buying and remained unchanged for selling, closing at 76.90 and 77.45, respectively.

Against Saudi Riyal, the PKR lost 5 paise for buying and remained unchanged for selling, closing at 75.16 and 75.70, respectively.

Open-market rates for dollar on Wednesday

BID Rs 282.28

OFFER Rs 283.72

American Dollar Exchange Rate

American Dollar Exchange Rate