The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has reduced the key policy rate by 100 basis points, taking it to 19.5%, its second successive decision of a cut.

“We have noted that the inflation is on a declining trend,” SBP Governor Jameel Ahmad said as he addressed a press conference after the MPC meeting on Monday.

In a statement issued separately, the MPC observed that the June 2024 inflation was slightly better than anticipated.

“The Committee also assessed that the inflationary impact of the FY25 budgetary measures was broadly in line with earlier expectations,” the SBP statement added.

It said that the external account has continued to improve, as reflected by the build-up in SBP’s foreign exchange reserves despite substantial repayments of debt and other obligations.

“Considering these developments – along with significantly positive real interest rate – the Committee viewed that there was room to further reduce the policy rate in a calibrated manner to support economic activity, while keeping inflationary pressures in check,” it said.

The MPC was of the view that despite the latest rate cut, the monetary policy stance remains “adequately tight to guide inflation towards the medium-term target of 5–7%”.

The committee stated that sentiment surveys conducted in July showed a worsening in inflation expectations and confidence of both consumers and businesses.

During his press conference, the SBP chief said the central bank expects Pakistan to record GDP growth of 2.5-3.5% in FY25.

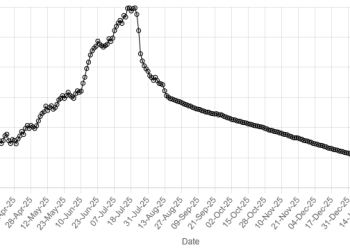

Outlook on inflation

Pakistan has been hit by runaway inflation in recent years with the CPI-based figure hitting a record high of 38% in May last year. That reading has since slowed, but is still nowhere near the medium-term target set by the SBP.

In fact, the reading also increased in June 2024 when compared with the previous month, and the SBP said the the increase was primarily driven by higher electricity tariffs and Eid-related increase in prices, which were partly offset by the downward adjustments in domestic fuel prices.

American Dollar Exchange Rate

American Dollar Exchange Rate