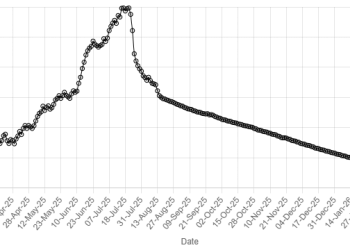

Selling pressure continued at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index shedding over 1,300 points during the trading session on Tuesday.

The index opened on a positive note, hitting an intraday high of 176,131.35. However, the gains proved short-lived as profit-taking emerged almost immediately.

The market staged a noticeable rebound around 12pm; however, the recovery lacked momentum and failed to sustain. Selling intensified again in the final hour, dragging the index toward the intraday’s low of 171,693.39.

At close, the benchmark index settled at 173,150.41, a decrease of 1,303.52 points or 0.75%.

In a key development, the National Electric Power Regulatory Authority (Nepra) has granted protection to existing prosumers till expiry of their seven-year contracts with Discos/ K-Electric through amendments to the notified Prosumer Regulations 2026, following a communication from the Power Division.

On Monday, PSX suffered a heavy sell-off as intense and broad-based selling of stocks dragged benchmark indices sharply lower, wiping out significant market value amid deteriorating investor sentiment and heightened risk aversion. The benchmark KSE-100 Index recorded a steep fall of 5,149.79 points, or 2.87%, to close at 174,453.94 points.

Internationally, Asian financial markets were treading carefully on Tuesday in holiday-thinned trading, but oil pushed higher with US and Iran nuclear negotiations in Geneva due to begin later in the day.

Mainland Chinese, Hong Kong, Singapore, Taiwan and South Korea markets were closed on Tuesday for Lunar New Year holidays.

US markets were shut on Monday for Presidents’ Day.

Japan’s Nikkei was down 0.5%, and the broader Topix slid 0.2% to 3,779.29. In Australia, the S&P/ASX200 was trading almost 0.5% higher.

Ten-year Treasury yields slipped 1 basis point to 4.044% on Tuesday, hitting the lowest since early December. Japan’s five-year yield fell 2 basis points to 1.65%, its lowest since February 2.

In early Asian trading hours, Nasdaq futures were down 0.1%, and S&P 500 futures were up 0.2%.

Selling pressure continued at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index shedding over 1,300 points during the trading session on Tuesday.

The index opened on a positive note, hitting an intraday high of 176,131.35. However, the gains proved short-lived as profit-taking emerged almost immediately.

The market staged a noticeable rebound around 12pm; however, the recovery lacked momentum and failed to sustain. Selling intensified again in the final hour, dragging the index toward the intraday’s low of 171,693.39.

At close, the benchmark index settled at 173,150.41, a decrease of 1,303.52 points or 0.75%.

In a key development, the National Electric Power Regulatory Authority (Nepra) has granted protection to existing prosumers till expiry of their seven-year contracts with Discos/ K-Electric through amendments to the notified Prosumer Regulations 2026, following a communication from the Power Division.

On Monday, PSX suffered a heavy sell-off as intense and broad-based selling of stocks dragged benchmark indices sharply lower, wiping out significant market value amid deteriorating investor sentiment and heightened risk aversion. The benchmark KSE-100 Index recorded a steep fall of 5,149.79 points, or 2.87%, to close at 174,453.94 points.

Internationally, Asian financial markets were treading carefully on Tuesday in holiday-thinned trading, but oil pushed higher with US and Iran nuclear negotiations in Geneva due to begin later in the day.

Mainland Chinese, Hong Kong, Singapore, Taiwan and South Korea markets were closed on Tuesday for Lunar New Year holidays.

US markets were shut on Monday for Presidents’ Day.

Japan’s Nikkei was down 0.5%, and the broader Topix slid 0.2% to 3,779.29. In Australia, the S&P/ASX200 was trading almost 0.5% higher.

Ten-year Treasury yields slipped 1 basis point to 4.044% on Tuesday, hitting the lowest since early December. Japan’s five-year yield fell 2 basis points to 1.65%, its lowest since February 2.

In early Asian trading hours, Nasdaq futures were down 0.1%, and S&P 500 futures were up 0.2%.