The Pakistan Stock Exchange (PSX) observed another volatile session on Tuesday, as the benchmark KSE-100 Index settled with a loss of over 750 points amid late session profit-taking.

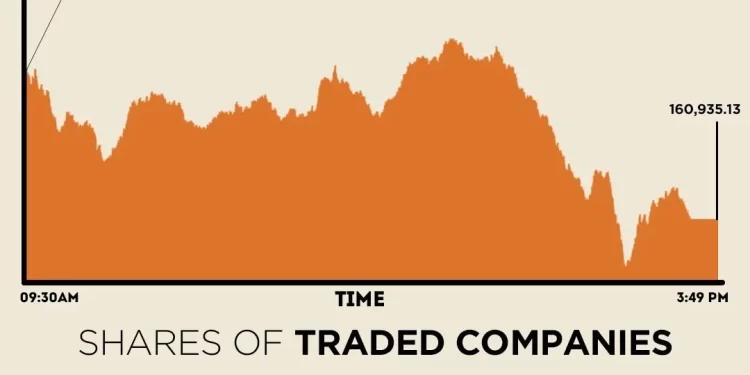

The market opened near the 162,000 level and experienced fluctuations through midday, but later made a modest recovery.

However, selling pressure engulfed the bourse during the final hours of the trading session, dragging the KSE-100 to an intra-day low of 160,583.89.

At close, the benchmark index settled at 160,935.13, a decrease of 752.05 points or 0.47%.

“With international markets trading in the red, the local bourse followed the global trend, while a lack of fresh positive news flows prompted investors to trim their positions and book profits, keeping sentiment cautious throughout the session,” brokerage house Topline Securities said in its post-market report.

Index-heavy stocks including PIOC, POL, PSEL, DGKC, and PTC posted notable gains, collectively contributing 206 points to the benchmark. On the flip side, ENGROH, MEBL, BAHL, and UBL together dragged the index lower by 360 points, it added/

On the fiscal front, Pakistan’s current account posted a deficit of $112 million in October 2025, data released by the State Bank of Pakistan (SBP) showed.

The deficit came on the back of a significantly higher import bill and lower exports during the month.

On Monday, PSX began the week on a measured note, closing mixed as the market oscillated between gains and profit-taking throughout the session. The benchmark index slipped to 161,687.18, reflecting a decline of 248.01 points.

Internationally, Asian stocks slid in early trade on Tuesday, as financial markets waited on a rush of key U.S economic data delayed by the government shutdown, while investors rolled back bets of a Federal Reserve rate cut next month.

Traders are looking to the US data to provide clues on the health of the world’s largest economy, with the closely watched September nonfarm payrolls report due on Thursday.

Focus in the region was also on Japan’s new Prime Minister Sanae Takaichi’s meeting with Bank of Japan governor Kazuo Ueda at 0630 GMT, the first discussions to be held between the pair since the new leader was inaugurated last month.

Ueda has signalled the chance of an interest rate hike as soon as next month. But Takaichi and her finance minister, Satsuki Katayama, have made clear their preference for rates to remain low until inflation durably meets the BOJ’s 2% target.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.7% while Japan’s Nikkei was off more than 2%.

Volume on the all-share index increased to 1,545.93 million from 1,214.42 million recorded in the previous close. The value of shares declined to Rs38.85 billion from Rs41.38 billion in the previous session.

WorldCall Telecom was the volume leader with 459.37 million shares, followed by Bank Makramah with 166.20 million shares, and Beco Steel Ltd with 134.30 million shares.

Shares of 474 companies were traded on Tuesday, of which 179 registered an increase, 249 recorded a fall, and 46 remained unchanged.