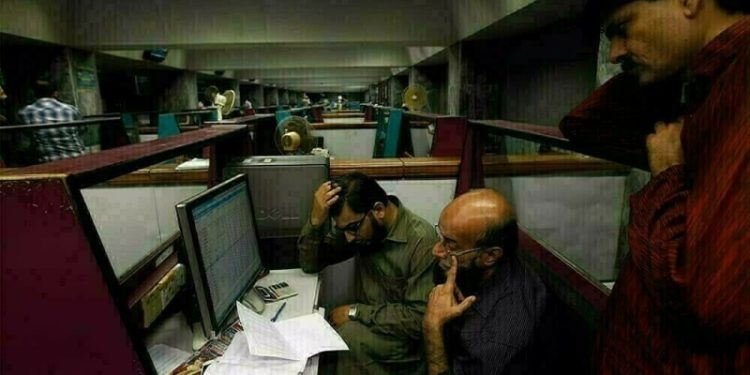

Pakistan Stock Exchange (PSX) came under pressure during the opening hours of trading on Wednesday, with the benchmark KSE-100 Index losing over 200 points.

At 10:35am, the benchmark index hovered at 114,292.71, a decrease of 235.37 points or 0.21%.

Selling was observed in key sectors including commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including HBL, MCB, NBP, MARI, OGDC, PPL, PSO, SHEL and HUBCO traded in the red.

In a key development, it was learnt that an International Monetary Fund (IMF) mission is expected to reach Pakistan on March 3, for the first review of the $7 billion Extended Fund Facility (EFF) programme.

Official sources revealed that the nine-member IMF mission led by Nathan Porter would stay in the country for around two weeks.

In the first phase, negotiations would take place on technical aspects, which policy-level talks would follow in the second phase. Sources revealed that the budget for 2025-26, currently in the process of being formulated, in all probability would be reviewed.

On Tuesday, the PSX benchmark KSE-100 Index closed marginally higher after selling in the second half erased most of its earlier gains. The KSE-100 settled at 114,528.09, up by 197.98 points or 0.17%.

Globally, Asia shares rose ahead of AI darling Nvidia’s earnings later in the day.

US copper prices surged more than 4% while those elsewhere fell overnight after President Donald Trump ordered a probe into potential new tariffs on copper imports on Tuesday.

Data on Tuesday showed US consumer confidence deteriorated at its sharpest pace in 3-1/2 years in February – the latest in a string of surveys suggesting that businesses and consumers were becoming increasingly rattled by the Trump administration’s policies.

Traders reacted by ramping up bets of more Federal Reserve rate cuts this year, with futures now pointing to nearly 60 basis points worth of easing priced in by year-end, up from about 40 bps a week ago.

In stocks, MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.63% on Wednesday, helped by a rally in Chinese markets.

Hong Kong’s Hang Seng Index surged more than 2%, with the Hang Seng Tech index also rising 2.7%.

The CSI300 blue-chip index ticked up 0.54%, while the Shanghai Composite Index gained 0.7%.

This is an intra-day update