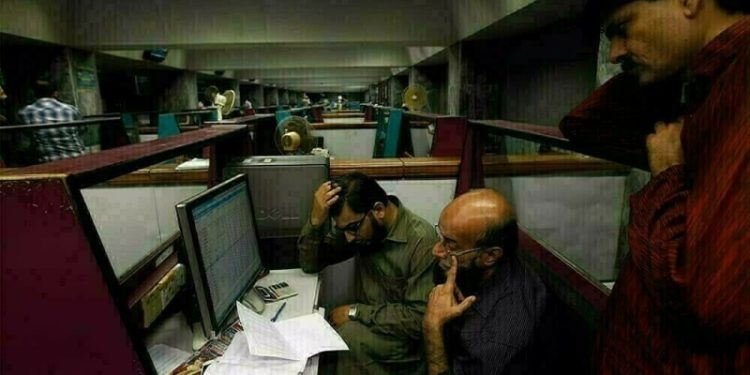

The Pakistan Stock Exchange (PSX) witnessed selling pressure on Wednesday, as its benchmark KSE-100 Index closed the day lower by 666 points.

The KSE-100 witnessed some buying in the initial hours, hitting an intra-day high of 114,762.93.

However, the bears gained ground in the latter hours and pushed the index to an intra-day low of 113,849.93.

At close, the benchmark index settled at 113,862.33, down by 665.76 points or 0.58%.

“After two days of strong buying by local mutual funds, as reflected in NCCPL data, the market took a breather today as investors opted for profit booking, resulting in a volatile session,” brokerage house Topline Securities said in its post-market report.

The downward movement was primarily driven by ENGROH, OGDC, PPL, MARI, and PSO, which collectively shaved 417 points off the index, it added.

In a key development, a mission from the International Monetary Fund (IMF) will arrive in Pakistan next week, Finance Minister Muhammad Aurangzeb said on Wednesday, with a first review of a $7 billion bailout programme due in March.

Official sources revealed that the nine-member IMF mission led by Nathan Porter would stay in the country for around two weeks.

In the first phase, negotiations would take place on technical aspects, which policy-level talks would follow in the second phase. Sources revealed that the budget for 2025-26, currently in the process of being formulated, in all probability would be reviewed.

On Tuesday, the KSE-100 Index closed marginally higher after selling in the second half erased most of its earlier gains. The index settled at 114,528.09, up by 197.98 points or 0.17%.

Globally, Asia shares rose ahead of AI darling Nvidia’s earnings later in the day.

US copper prices surged more than 4% while those elsewhere fell overnight after President Donald Trump ordered a probe into potential new tariffs on copper imports on Tuesday.

Data on Tuesday showed US consumer confidence deteriorated at its sharpest pace in 3-1/2 years in February – the latest in a string of surveys suggesting that businesses and consumers were becoming increasingly rattled by the Trump administration’s policies.

Traders reacted by ramping up bets of more Federal Reserve rate cuts this year, with futures now pointing to nearly 60 bps worth of easing priced in by year-end, up from about 40 bps a week ago.

In stocks, MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.63% on Wednesday, helped by a rally in Chinese markets.

Hong Kong’s Hang Seng Index surged more than 2%, with the Hang Seng Tech index also rising 2.7%.

The CSI300 blue-chip index ticked up 0.54%, while the Shanghai Composite Index gained 0.7%.

Meanwhile, the Pakistani rupee recorded a marginal decline, appreciating 0.02% against the US dollar in the inter-bank market on Wednesday. At close, the rupee settled at 279.62, a gain of Re0.05 against the greenback.

Volume on the all-share index increased to 640.18 million from 495.98 million recorded in the previous close.

However, the value of shares declined to Rs22.74 billion from Rs29.36 billion in the previous session.

Cnergyico PK was the volume leader with 83.86 million shares, followed by Pak Int.Bulk with 49.25 million shares, and Sui South Gas with 39.44 million shares.

Shares of 446 companies were traded on Wednesday, of which 126 registered an increase, 260 recorded a fall, while 60 remained unchanged.

American Dollar Exchange Rate

American Dollar Exchange Rate