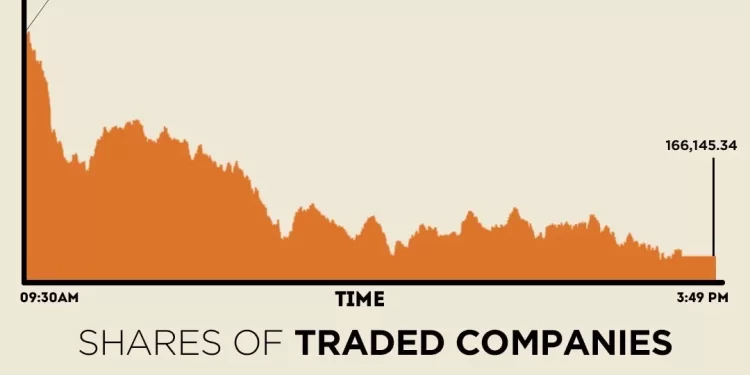

Selling pressure was observed at the Pakistan Stock Exchange (PSX), as the benchmark KSE-100 Index settled down nearly 1,500 points on Wednesday.

Negative sentiment persisted throughout the trading session, pushing the KSE-100 to an intra-day low of 166,115.17.

At close, the benchmark index settled at 166,145.34, down 1,496.93 points or 0.89%.

Market sentiment remained under pressure, with several heavyweights — FFC, MEBL, UBL, HUBC, and ENGRO — acting as major drags on the index. Collectively, these stocks erased approximately 858 points from the benchmark, brokerage house Topline Securities said in its post-market report.

On Tuesday, the PSX witnessed a broadly negative trading session, with major indices, sectoral benchmarks, and futures contracts closing lower amid persistent profit-taking. The KSE-100 Index fell 419.92 points to close at 167,642.28, down 0.25%.

“Going forward, the market is expected to continue consolidating within the 166–168k range before attempting another push toward a new all-time high. On the downside, the 165k level is likely to serve as the first key support,” Ali Najib, Deputy Head of Trading, Arif Habib Ltd, said in a statement.

On a corporate front, the PSX advised K-Electric Limited (KE) to file its outstanding annual financial statements and convene Annual General Meetings (AGMs) for FY24 and FY25 no later than March 31, 2026.

Internationally, Asian shares were on a steadier footing on Wednesday, helped by an overnight rebound on Wall Street as a brief selloff in global bond markets and cryptocurrencies abated.

Bitcoin reclaimed the $90,000 level while Nasdaq and S&P 500 futures rose 0.1% each.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.3% while Japan’s Nikkei advanced 0.8%.

Calm was restored to markets on Wednesday after an ugly start to the week, where expectations of a looming rate hike in Japan triggered a global bond selloff and exacerbated a slide in cryptocurrencies, leaving stocks caught in the rush from risk assets.

Given the lack of major market catalysts for now, analysts said the focus also shifted back to an expected rate cut from the Federal Reserve next week, which has improved market sentiment.

December has historically been a good month for stocks.

Investors have also been pricing in a more dovish Fed outlook, on the view that White House economic adviser Kevin Hassett, reportedly the frontrunner to become the next chair, would deliver further rate cuts once he succeeds Jerome Powell.

Meanwhile, the Pakistani rupee saw marginal improvement against the US dollar in the inter-bank market on Wednesday. At close, the local currency settled at 280.46, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 593.08 million from 775.54 million recorded in the previous close. The value of shares increased to Rs44.42 billion from Rs37.49 billion in the previous session.

WorldCall Telecom was the volume leader with 78.64 million shares, followed by Hub Power Co with 46.64 million shares, and TRG Pak Ltd with 33.19 million shares.

Shares of 473 companies were traded on Wednesday, of which 136 registered an increase, 291 recorded a fall, and 46 remained unchanged.