A record-breaking buying spree at the Pakistan Stock Exchange (PSX) came to a screeching halt on Tuesday as the benchmark KSE-100 Index registered a decline of over 1,000 points on profit-taking and selling pressure.

The KSE-100 witnessed a volatile trading session, hitting an intra-day high of 111,759.58, a gain of over 1,700 points during the opening hours of trading.

However, by 2:40pm, the index had hit an intra-day low of 107,711.40 as investors looked to book their gains after days of intense buying.

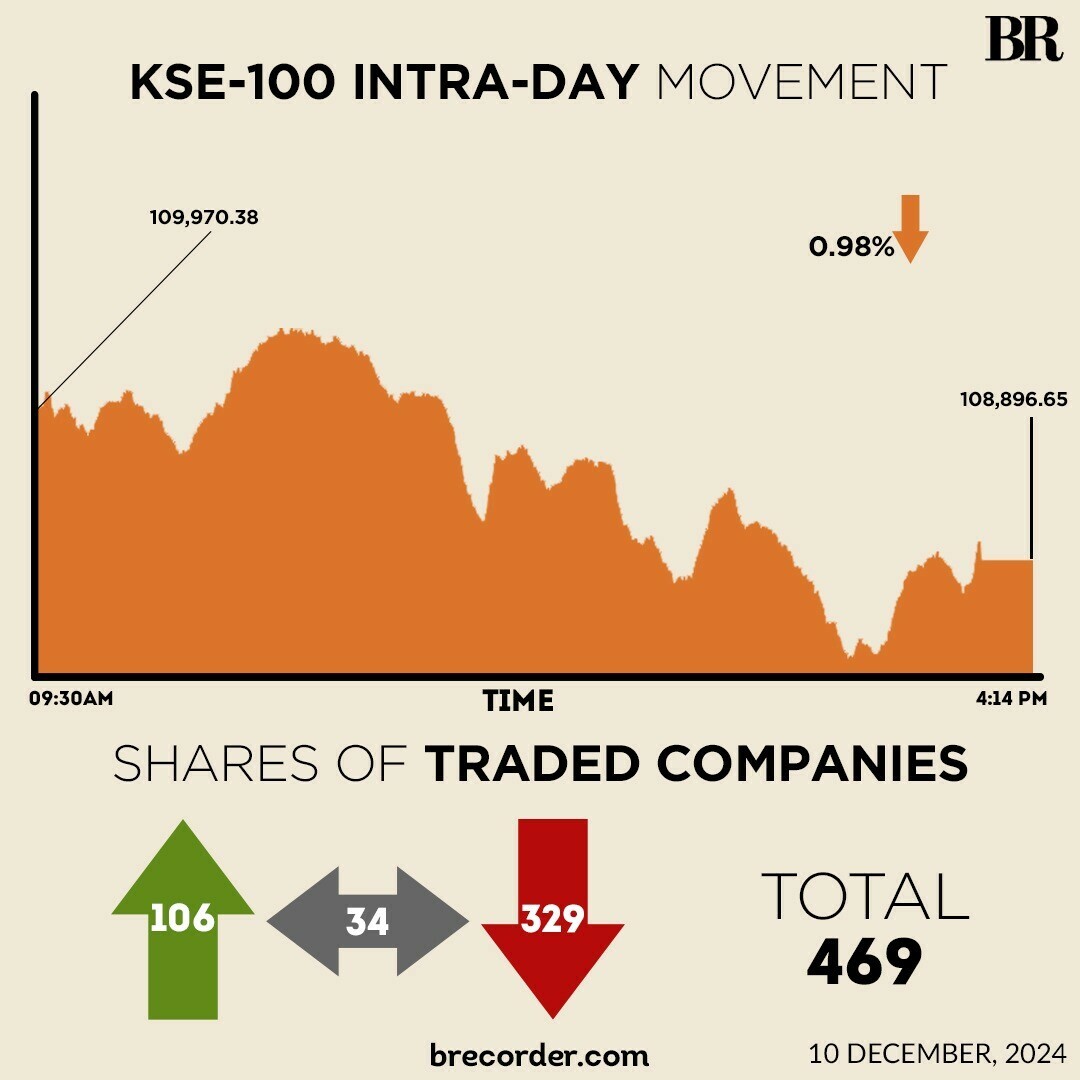

At close, the benchmark index settled at 108,896.65 for an overall decrease of 1,073.73 points or 0.98%.

“The session began on a bullish note, driven by robust buying interest in key sectors following encouraging macroeconomic developments. However, the gains were short-lived as investors opted to lock in profits, especially in heavyweight sectors, leading to a sharp intraday decline,” brokerage house Topline Securities said in its post-market report.

“Despite the turbulence, the market managed to close off its lows, signalling underlying investor confidence,” it added.

Early-morning interest was observed in key sectors including power generation, refinery, oil and gas exploration companies, OMCs, fertiliser, automobile assemblers and cement.

The rally was underpinned by improving macroeconomic indicators, notably high inflows of remittances, according to market experts.

The inflow of overseas workers’ remittances into Pakistan stood at $2.92 billion in November 2024, 4.5% lower when compared to $3.05 billion in October 2024, showed data released by the State Bank of Pakistan (SBP).

Investor interest has also recently been driven by optimism of further cuts in interest rates after a significant decrease in the inflation rate, which declined to 4.9% in November.

On Monday, PSX continued its bullish trend and hit new highest-ever levels settling at 109,970.38, an increase of 916.43 points or 0.84%.

However, experts say some level of profit-taking was expected as the index had hit record highs in recent days.

Globally, China and Hong Kong stocks surged at open on Tuesday after top policymakers vowed to ramp up policy stimulus to spur growth.

The blue-chip CSI300 index rallied 3.2% at open, while the Shanghai Composite index added 2.6%. Hong Kong’s benchmark Hang Seng jumped 3.2% at open, adding to Monday’s 2.8% gain.

The tech index surged 4.2%.

Next year, China will adopt an “appropriately loose” monetary policy, the first easing of its stance in some 14 years, alongside a more proactive fiscal policy to spur economic growth, state media Xinhua reported after-market on Monday, citing a readout of a meeting of top Communist Party officials, the Politburo.

Meanwhile, the Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Tuesday. At close, the currency settled at 278.05, a loss of Re0.07 against the greenback.

Volume on the all-share index decreased to 1,548.30 million from 1,597.87 million on Monday.

However, the value of shares rose to Rs68.80 billion from Rs60.25 billion in the previous session.

WorldCall Telecom was the volume leader with 200.87 million shares, followed by Cnergyico PK with 150.69 million shares, and K-Electric Ltd with 73.03 million shares.

Shares of 469 companies were traded on Tuesday, of which 106 registered an increase, 329 recorded a fall, while 34 remained unchanged.