Strong buying momentum was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining nearly 2,500 points during trading on Thursday.

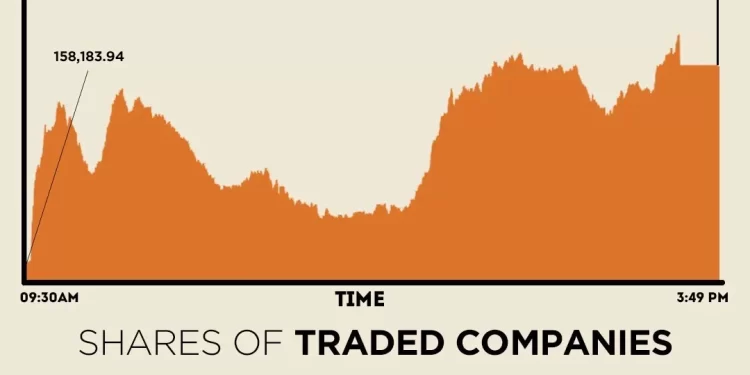

The intra-day trend showed early gains, mid-session consolidation, and a strong close near the day’s high, reflecting continued bullish sentiment at the bourse.

At close, the benchmark index settled at 160,657.49, a gain of 2,473.55 points or 1.56%.

Analysts attributed the bull run to the announcement of the International Monetary Fund (IMF) Executive Board meeting.

The IMF included Pakistan on its Executive Board agenda on December 08, 2025, according to its updated website.

The Executive Board is set to deliberate final approval for the release of the next $1.2 billion tranche, covering the second review of the Extended Fund Facility (EFF) and the first review of the Resilience and Sustainability Facility (RSF).

Meanwhile, brokerage house Topline Securities in its post-market report said the Thursday’s rally was fueled by renewed investor optimism following merger and acquisition developments in the cement sector.

Index-heavy stocks including FFC, LUCK, MLCF, DGKC, and MARI were among the major gainers, collectively contributing 1,309 points to the benchmark. On the flip side, HMB, AIRLINK, TRG, and INIL together shaved off 54 points, Topline said.

On Wednesday, the PSX staged a modest recovery, rebounding after a sharp downturn in the previous session. The KSE-100 Index gained 313.44 points, or 0.20%, to close at 158,183.95.

Globally, stocks and gold paused for breath on Thursday as the US Congress voted to end the longest government shutdown on record, with markets waiting for the resumption of US economic data to gauge the rates outlook.

US stock futures traded either side of flat.

Japan’s Nikkei was 0.5% firmer, but the broad Topix index climbed nearly 1% to a record high as investors shifted portfolios from the frothiest artificial intelligence firms to buy exposure to other parts of the economy.

Similar moves had been afoot overnight, along with a jump in the gold price above $4,200 an ounce and a modest rally for bonds that has the US 10-year yield at 4.067%.

US President Donald Trump, who was expected to host Wall Street executives for dinner on Wednesday, would sign a bill to end the government’s shutdown at 9:45 p.m. (0245 GMT), the White House said.

Delayed economic data will likely trickle out next week, economists expect, and the focus is on whether it will back up private surveys that have shown softness in the job market.

Hong Kong’s Hang Seng retreated slightly from a one-month high, and the Shanghai Composite rose 0.1%.

On Wall Street, the Dow Jones index notched a record high overnight while the tech-heavy Nasdaq retreated.

Meanwhile, the Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Thursday. At close, the currency settled at 280.76, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 797.18 million from 757.24 million recorded in the previous close. The value of shares declined to Rs35.12 billion from Rs33.41 billion in the previous session.

Bank Makramah was the volume leader with 112.16 million shares, followed by Dost Steels Ltd with 48.74 million shares, and F. Nat.Equities with 40.35 million shares.

Shares of 477 companies were traded on Thursday, of which 285 registered an increase, 142 recorded a fall, and 50 remained unchanged.