SoftBank Group’s $5.8 billion sale of its Nvidia stake jolted stock markets on Tuesday, stoking fears that the frenzy around artificial intelligence may have peaked, especially after recent warnings from Wall Street bank chiefs and a famed short seller.

In its quarterly results, the Japanese tech investor said it had sold all the 32.1 million Nvidia shares it held in October to bankroll CEO Masayoshi Son’s sweeping AI push, built around his “all in” bet on ChatGPT-creator OpenAI.

SoftBank needs the proceeds for initiatives including the $500 billion Stargate project to expand U.S. data-center capacity for AI and about $40 billion pledged to OpenAI, whose financing details were not given with the announcements.

But the timing of its sale deepened some investor doubts that valuations in the AI industry might have gotten ahead of fundamentals.

Nvidia shares were down 1.7% in premarket trading, dragging down futures for the wider U.S. market. Adding to the jitters was a revenue forecast cut from AI cloud provider CoreWeave over a contract delay that sent its stock down 7%.

SoftBank gets $7.6bn T-Mobile stake windfall, shares soar

Drumbeats of an AI bubble grew louder in recent weeks after Morgan Stanley and Goldman Sachs CEOs warned equities could be heading to a drawdown, while hedge fund manager Michael Burry, known for shorts on the U.S. housing market ahead of the 2008 crash, bet against Nvidia and Palantir.

Many analysts said the sale suggested Son – one of tech’s most audacious investors – sees the blistering rally that turned Nvidia into the first $5 trillion company last month cooling after a more than 1,200% surge in the past three years.

But a few of them pointed to SoftBank’s patchy record managing its Nvidia holdings. The company, by some estimates, missed out on a more than $100 billion rally in Nvidia shares by selling it off in 2019 before the AI boom took off, only to later buy the chipmaker’s shares again.

“As for timing, cannot say Masayoshi Son has been great with his trading of NVDA shares,” said C J Muse, Senior Managing Director at Cantor Fitzgerald. “It appears simply resource allocation – finding funds to make bets elsewhere.”

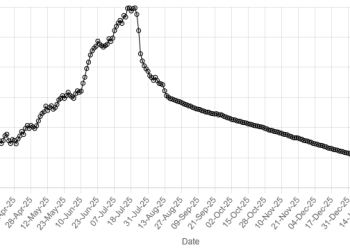

American Dollar Exchange Rate

American Dollar Exchange Rate