CANBERRA: US soybean futures edged lower on Friday at the end of a see-saw week during which Chinese purchases of US beans pushed prices to a 17-month high before doubts about whether China would sustain so rapid a pace of buying punctured the rally.

Corn and wheat futures also fell, with all three crops under pressure from ample supply.

The most-active soybean contract on the Chicago Board of Trade (CBOT) was down 0.1% at $11.21-3/4 a bushel at 0446 GMT.

The contract was set to end the week 0.2% lower after reaching $11.69-1/2 on Tuesday, its highest since June 2024.

CBOT corn for March delivery fell 0.2% to $4.37 a bushel but was on track for a weekly loss of 1.6%.

Wheat slipped 0.7% to $5.37-1/4 a bushel and was down 0.8% from last Friday’s close.

Soybeans are still up more than 10% since mid-October and corn and wheat hit multi-month highs in recent days – the rallies driven by trade negotiations that have revived Chinese purchases of US farm goods.

The US Department of Agriculture on Thursday confirmed that China had bought more than 1.5 million tons of soybeans and 132,000 metric tons of US white wheat this week.

However, China’s soybean purchases remain far off the 12 million tons that US officials said it promised to buy by year-end.

“US beans are now priced higher than Brazilian beans,” said Rod Baker, an analyst at Bendigo Agribusiness Insights.

“We wouldn’t be surprised if Chinese purchases from the US are closer to a trickle than a flood,” he said.

Commodity funds have been net sellers of CBOT soybeans, wheat and corn so far this week, traders say. They hold net short positions in all three crops.

The International Grains Council on Thursday raised its forecasts for 2025/26 global wheat and corn production.

It trimmed its soybean harvest estimate but still expects the second-largest crop on record.

Consultants Sovecon meanwhile raised their 2025 Russian wheat production forecast and said another bumper crop was likely next year.

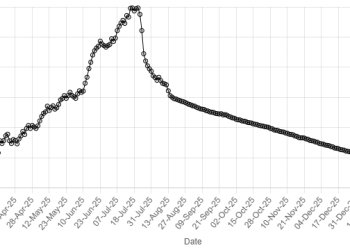

American Dollar Exchange Rate

American Dollar Exchange Rate