State Bank of India beat quarterly profit estimates on Friday, driven by treasury income and curtailed expenses, but its lending margin declined.

The state-run bank, the country’s largest lender by assets, reported a net profit of 191.60 billion rupees (about $2.2 billion) in the three months to June end, compared with 170.35 billion rupees a year earlier.

Analysts, on average, had expected a profit of 175.52 billion rupees, according to data compiled by LSEG.

SBI’s net interest income, the difference between interest earned on loans and paid on deposits, declined by 0.1% year-on-year to 410.72 billion rupees, but its profit from treasury operations more than tripled.

Operating expenses rose 8% year-on-year but fell 22% from the prior three months, helping its earnings, the lender said.

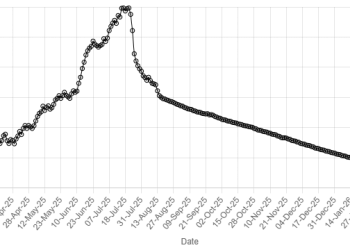

The Reserve Bank of India kept its key repo rate unchanged in August after cutting it by 100 basis points since February.

State Bank of India to plan $2.9bn share sale as soon as next week

In a falling interest rate environment, lenders typically pass on the rate cuts to borrowers, but deposit rates fall with a lag, compressing margins.

The bank’s domestic net interest margin declined to 3.02% in the quarter from 3.22% in the previous three months and 3.35% a year earlier.

Its gross advances grew 11.6% year-on-year, while total deposits rose by 11.7%.

SBI’s loan growth for the fiscal year ending in March should be higher than the industry average, analysts have said.

The bank’s so-called gross non-performing asset ratio slightly rose to 1.83% from 1.82% in the prior quarter but improved from 2.21% a year earlier.

State Bank of India beat quarterly profit estimates on Friday, driven by treasury income and curtailed expenses, but its lending margin declined.

The state-run bank, the country’s largest lender by assets, reported a net profit of 191.60 billion rupees (about $2.2 billion) in the three months to June end, compared with 170.35 billion rupees a year earlier.

Analysts, on average, had expected a profit of 175.52 billion rupees, according to data compiled by LSEG.

SBI’s net interest income, the difference between interest earned on loans and paid on deposits, declined by 0.1% year-on-year to 410.72 billion rupees, but its profit from treasury operations more than tripled.

Operating expenses rose 8% year-on-year but fell 22% from the prior three months, helping its earnings, the lender said.

The Reserve Bank of India kept its key repo rate unchanged in August after cutting it by 100 basis points since February.

State Bank of India to plan $2.9bn share sale as soon as next week

In a falling interest rate environment, lenders typically pass on the rate cuts to borrowers, but deposit rates fall with a lag, compressing margins.

The bank’s domestic net interest margin declined to 3.02% in the quarter from 3.22% in the previous three months and 3.35% a year earlier.

Its gross advances grew 11.6% year-on-year, while total deposits rose by 11.7%.

SBI’s loan growth for the fiscal year ending in March should be higher than the industry average, analysts have said.

The bank’s so-called gross non-performing asset ratio slightly rose to 1.83% from 1.82% in the prior quarter but improved from 2.21% a year earlier.