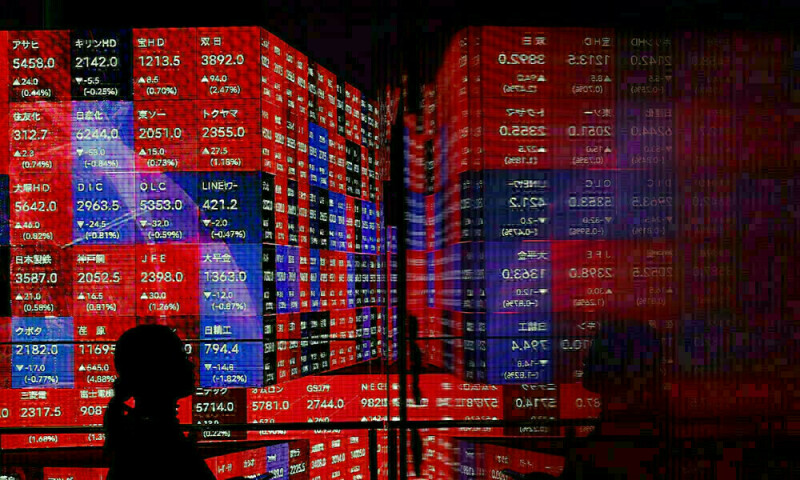

SYDNEY: Wall Street futures fell in Asia and Treasury yields held near eight-month highs on Friday as investors counted down to a U.S. jobs report that could exacerbate or ease the sell-off in the global bond market.

Nasdaq futures dropped 0.6% while S&P 500 futures were down 0.5%. Wall Street was closed overnight to mark the funeral of former U.S. President Jimmy Carter.

Japan’s, tab fell 0.8%, adding to its weekly losses to 1.5%. MSCI’s broadest index of Asia-Pacific shares outside Japan, was flat but headed for a weekly decline of 0.7%.

hina’s blue-chips, slipped 0.1%, but Hong Kong’s Hang Seng, rose 0.5%.

Chinese government bond yields climbed after the central bank said it has decided to suspend treasury bond purchases temporarily due to short supply of the bonds.

For the global bond market, much is riding on the U.S. monthly payrolls report due on Friday.

Median forecasts are for a rise of 160,000 in jobs in December with unemployment holding at 4.2%. Anything stronger could see 10-year Treasury yields spike to 13-month peaks and lift the U.S. dollar in the process.

Analysts at ING believe a print below 150,000 jobs will be needed to stop Treasury yields from rising further.

“Payrolls, as always, are a pivotal report. But we need to deviate materially from consensus to have an effect this time around,” said Padhraic Garvey, regional head of research, Americas, at ING.

“Given the move already in Treasuries, there is some talk that Friday’s numbers will need to be strong to continue this momentum, and in that sense there is some vulnerability for a lower yield reaction to a consensus outcome.”

Bond selloff slows in Asia, stocks fall with eyes on UK gilts, US policy

Overnight, Philadelphia Fed President Patrick Harker said he expects the U.S. central bank to cut interest rates, but added that an imminent move down isn’t needed.

Kansas City Fed President Jeff Schmid signaled a reluctance to cut interest rates.

Markets have already scaled back expectations to around 43 basis points of U.S. rate cuts for 2025, while concerns about President-elect Donald Trump’s potentially inflationary agenda have helped drive up longer-term yields.

The benchmark 10-year U.S. Treasury yield held at 4.6791%, just below an eight-month peak of 4.73% hit on Wednesday.

The big chart level is the 4.739% and if that breaks, bears would be targeting the psychologically important level of 5%, highs not seen since 2007.

The climb in Treasury yields – up about 8 bps this week – has bolstered the dollar index to 109.14, up for the sixth straight week.

Worries about Britain’s economy have kept the pound under pressure and hit gilts especially hard, driving yields to 16-1/2-year highs, although they did end Thursday largely steady .

The pound slipped 0.1% on Friday to $1.2292, having touched its lowest since November 2023 overnight. It is down 1% this week.

Oil prices rose on Friday. U.S. West Texas Intermediate crude futures rose 0.4% to $74.24 and were set for a weekly gain of 0.4%.

Gold prices rose 1.2% in the week to $2,670.58 an ounce, near its highest level since December.