LONDON/TOKYO: Global stocks gained and gold traded near record highs on Thursday as investors digested the potential ramifications of a U.S. government shutdown, while a weak private U.S. labour market report bolstered bets for Federal Reserve rate cuts.

A protracted U.S. government shutdown could mean that the release of key official data on employment and inflation is delayed or disrupted, clouding the picture on the health of the world’s biggest economy and the path for interest rates.

A monthly payrolls report seems unlikely now to be released on Friday, putting an overnight ADP employment report that shows the economy unexpectedly shed jobs in September into sharper focus. Traders are now pricing in two quarter-point Fed rate cuts by the end of the year as almost a done deal.

“I hope they sort this out rapidly,” said Kevin Thozet, investment committee member at asset manager Carmignac, referring to the government shutdown, adding that inflation data was also due ahead of the Fed’s next meeting.

“It’s like a blind man walking with a blind dog,” he said.

Shutdown angst hurts dollar, boots gold

While U.S. stocks have performed well, he added, uncertainty about the credibility of U.S. institutions more generally has manifested in a weaker dollar.

The MSCI’s broadest index of global stocks was up about 0.25% on Thursday, after European stocks hit another record high, up about 0.6%.

Wall Street futures were also up between 0.2 and 0.4%.

Tech shares in Asia had earlier rallied, helping drive up the region’s stock indexes, partly lifted by news that South Korean chip heavyweights Samsung and Hynix inked partnerships to supply OpenAI data centres.

The combination of Fed easing bets and some shutdown angst pushed gold to a fresh all-time high of $3,895.09 overnight, while also supporting U.S. Treasuries, sending yields sharply lower.

The two-year Treasury yield sank to a two-week low of 3.531% on Thursday, and was last at 3.5408%.

Gold paused for breath, last changing hands at around $3,869.

“As is often the case, fresh highs are likely to beget yet more fresh highs here, with momentum still firmly with the bulls, and the fundamental case for further upside in PMs (precious metals) a solid one too,” said Michael Brown, senior research strategist at Pepperstone.

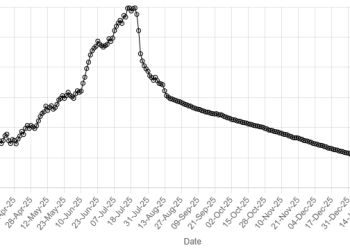

American Dollar Exchange Rate

American Dollar Exchange Rate