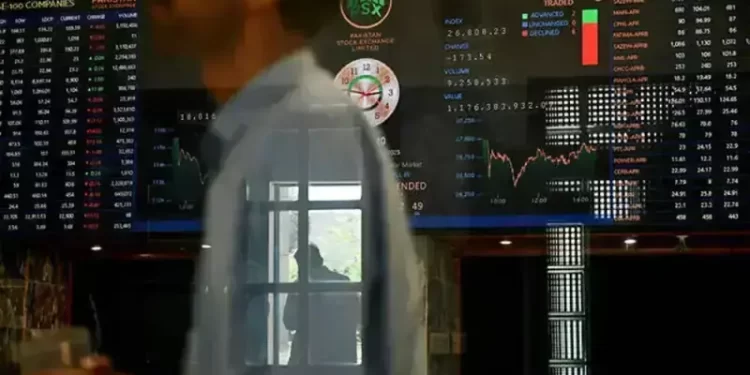

After initial buying momentum, the Pakistan Stock Exchange (PSX) witnessed a downward trend on Thursday, with the benchmark KSE-100 Index losing nearly 1,100 points during intra-day trading.

The market opened on a positive note but soon came under selling pressure, leading to a broad-based pullback as trading progressed.

At 2:30pm, the benchmark index was hovering at 158,497.47, a decrease of 1,080.72 points or 0.68%.

Selling pressure was observed in key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, refinery and power generation. Index-heavy stocks, including ARL, HUBCO, MARI, OGDC, POL, PPL, PSO, MCB, MEBL and NBP, traded in the red.

On Wednesday, PSX witnessed a sharp downturn as profit-taking and the absence of new market triggers weighed on investor sentiment. The KSE-100 Index plunged by 1,703.58 points, or 1.06%, to close at 159,578.19 points.

Internationally, Asian shares rose on Thursday, reversing a steep selloff from the previous session after better-than-expected US economic data drew investors back into markets trading near record highs.

Yields on US Treasuries, meanwhile, held overnight gains as traders further trimmed bets of a Federal Reserve rate cut next month, which in turn kept the dollar supported near a five-month peak.

Data on Wednesday showed the US services sector activity increased to an eight-month high in October as new orders grew solidly, while private payrolls rose 42,000 last month, exceeding expectations.

That helped lift Wall Street overnight as jitters over inflated technology stock valuations abated and upbeat company earnings also restored investors’ risk appetite.

In Asia, Japan’s Nikkei was up 1.5% after sliding 2.5% on Wednesday. South Korea’s Kospi also jumped more than 2% shortly after the open, having tumbled 2.85% in the previous session.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.32%.

Stock markets suffered a heavy selloff in Asia on Wednesday as concerns about stretched valuations spooked investors, though most said the slide was little cause for panic.

This is an intra-day update