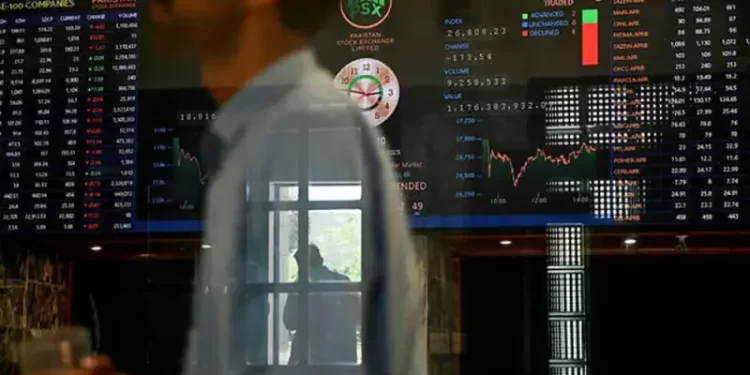

After days of profit-taking, buying momentum returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining over 950 points during Monday’s opening hours of trading.

At 10:05am, the benchmark KSE-100 was hovering at 155,389.90, an increase of 950.22 points or 0.62%.

Buying was observed in key sectors including commercial banks, fertiliser, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks, including ARL, HUBCO, MARI, POL, PPL, PSO, WAFI, HBL, NBP and UBL, traded in the green.

Moreover, the market participants await the State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) meeting today, which would decide on the key policy rate.

In the previous monetary policy meeting, held on June 30, 2025, the committee decided to keep the policy rate unchanged at 11% as the inflation outlook was somewhat worsened in the wake of higher-than-anticipated adjustments in energy prices, especially gas tariffs.

Analysts expect that the MPC will continue to keep the policy rate unchanged in the next meeting, as inflation is projected to increase due to recent flooding.

During the previous week, PSX experienced a volatile week, oscillating between record highs and profit-taking, before closing nearly unchanged.

The benchmark KSE-100 Index touched an all-time intraday peak of 157,817 points, but sustained selling later dragged it down to close the week at 154,440 points, marking a modest gain of 163 points or 0.1% WoW.

Internationally, stocks got off to a quiet start in Asia on Monday ahead of an action-packed week that is seemingly certain to see the US Federal Reserve resume its easing cycle, and perhaps leave the door wide open to a series of cuts.

The Bank of Canada is also expected to cut rates by a quarter point this week, while China’s central bank might trim one of its market rates amid a sluggish economy.

The Bank of Japan and Bank of England also meet and are both seen on hold.

Markets are 100% priced for an easing of 25 basis points from the Fed, taking its funds rate to 4.0-4.25%, with futures implying just a 4% chance of 50 basis points.

Just as important will be Fed members’ “dot plot” projections for rates and guidance from Fed Chair Jerome Powell on the extent and pace of any further easing.

Futures already have 125 basis points of cut priced in, so anything less than dovish will disappoint investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1%.

This is an intra-day update

After days of profit-taking, buying momentum returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining over 950 points during Monday’s opening hours of trading.

At 10:05am, the benchmark KSE-100 was hovering at 155,389.90, an increase of 950.22 points or 0.62%.

Buying was observed in key sectors including commercial banks, fertiliser, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks, including ARL, HUBCO, MARI, POL, PPL, PSO, WAFI, HBL, NBP and UBL, traded in the green.

Moreover, the market participants await the State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) meeting today, which would decide on the key policy rate.

In the previous monetary policy meeting, held on June 30, 2025, the committee decided to keep the policy rate unchanged at 11% as the inflation outlook was somewhat worsened in the wake of higher-than-anticipated adjustments in energy prices, especially gas tariffs.

Analysts expect that the MPC will continue to keep the policy rate unchanged in the next meeting, as inflation is projected to increase due to recent flooding.

During the previous week, PSX experienced a volatile week, oscillating between record highs and profit-taking, before closing nearly unchanged.

The benchmark KSE-100 Index touched an all-time intraday peak of 157,817 points, but sustained selling later dragged it down to close the week at 154,440 points, marking a modest gain of 163 points or 0.1% WoW.

Internationally, stocks got off to a quiet start in Asia on Monday ahead of an action-packed week that is seemingly certain to see the US Federal Reserve resume its easing cycle, and perhaps leave the door wide open to a series of cuts.

The Bank of Canada is also expected to cut rates by a quarter point this week, while China’s central bank might trim one of its market rates amid a sluggish economy.

The Bank of Japan and Bank of England also meet and are both seen on hold.

Markets are 100% priced for an easing of 25 basis points from the Fed, taking its funds rate to 4.0-4.25%, with futures implying just a 4% chance of 50 basis points.

Just as important will be Fed members’ “dot plot” projections for rates and guidance from Fed Chair Jerome Powell on the extent and pace of any further easing.

Futures already have 125 basis points of cut priced in, so anything less than dovish will disappoint investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1%.

This is an intra-day update

American Dollar Exchange Rate

American Dollar Exchange Rate