Strong buying momentum was observed at the Pakistan Stock Exchange (PSX) as investor confidence remained buoyant amid improved economic sentiment and policy clarity, with the benchmark KSE-100 Index closing with a gain of nearly 1,200 points on Monday.

Positive sentiments prevailed throughout the trading session, pushing the index to an intra-day high of 163,935.02.

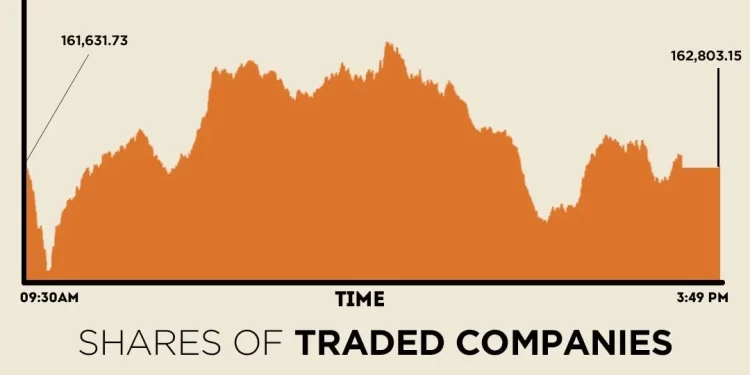

At close, the benchmark KSE-100 Index settled at 162,803.15, an increase of 1,171.42 points or 0.72%.

“The upward momentum from previous sessions persisted, supported by institutional inflows—particularly from local mutual funds, as indicated by NCCPL data,” said Topline Securities.

Heavyweight stocks such as FFC, ENGRO, NBP, HUBC, and TRG led the advance, collectively contributing 1,131 points to the index’s rise, it added.

In a key development, Pakistan’s headline inflation clocked in at 6.2% on a year-on-year (YoY) basis in October 2025, showed the Pakistan Bureau of Statistics (PBS) data on Monday, a reading higher than the Ministry of Finance estimate of 5-6%.

The stock market ended last week on a subdued note after a volatile trading period dominated by geopolitical concerns, profit-taking, and corporate earnings announcements. The benchmark KSE-100 Index declined by 1.03% week-on-week, closing at 161,631.73 points.

Internationally, Asian stocks rose on Monday as the US-China trade truce and soaring spending on artificial intelligence kept risk sentiment aloft, while the dollar held near a three-month high after hawkish comments from Federal Reserve policymakers.

Investors are still focused on developments from last week, including central bank meetings and the US-China agreement on a year-long trade truce that was within broad expectations. But doubts remain if the truce will last for the full duration.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.35% higher at 727.82, hovering near the 4-1/2-year high it touched last week. The index is up more than 27% this year, on course for its best year since 2017.

China’s blue-chip stocks eased 0.6% after data showed China’s factory activity in October expanded at a slower pace than in September as new orders and output both waned amid tariff anxiety. Hong Kong’s Hang Seng Index was 0.3% higher.

Japan markets are closed for a holiday with no cash Treasuries trading, resulting in muted activity during Asian hours.

Nasdaq futures were 0.25% higher, while European futures also pointed to a higher open.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar in the inter-bank market on Monday. At close, the currency settled at 280.90, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 949.36 million from 952.86 million recorded in the previous close. The value of shares rose to Rs47.58 billion from Rs42.27 billion in the previous session.

Hascol Petrol was the volume leader with 119.51 million shares, followed by B.O.Punjab with 81.17 million shares, and WorldCall Telecom with 44.13 million shares.

Shares of 486 companies were traded on Monday, of which 262 registered an increase, 176 recorded a fall, and 48 remained unchanged.