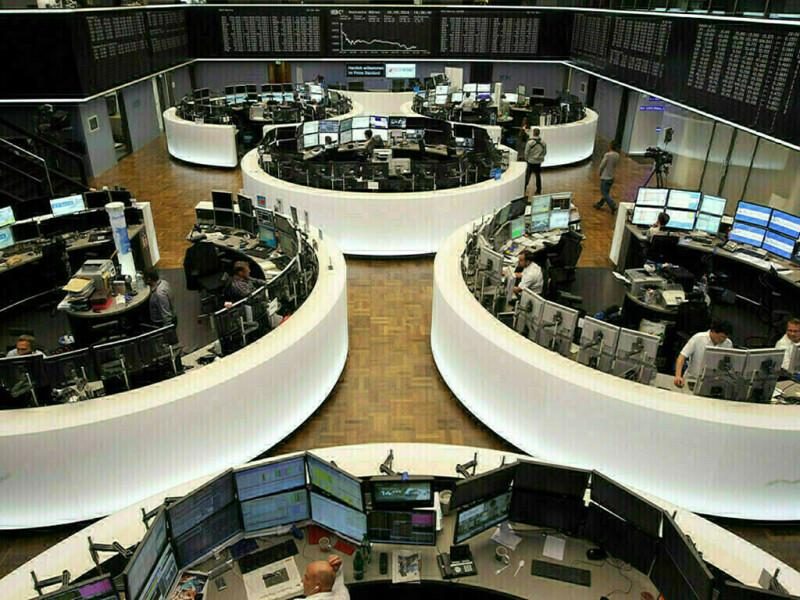

European shares ticked up on Friday, as investors parsed through a flurry of economic data from the region, while some of the focus shifted to Germany’s upcoming snap elections.

The pan-European STOXX 600 index edged up 0.3%, gaining some ground after hitting a one-week low on Thursday.

Still, the index was set to decline 0.2% for the week, potentially ending an eight-week winning streak — the longest since March 2024.

Through the week, investors had maintained a cautiously optimistic stance, evaluating the implications of US President Donald Trump’s recent tariff threats, while closely monitoring progress on a potential peace deal between Russia and Ukraine.

But as the week draws to a close, investors in Germany have turned their attention to the upcoming general election, following the collapse of Chancellor Olaf Scholz’s three-way coalition.

The election could lead to a conservative-led coalition government under pressure to implement significant changes to rejuvenate the stagnant economy.

European shares flat as losses in energy counter industrials’ boost

The country’s benchmark index was flat, while domestic-focused German mid caps were up 0.8% on Friday, having hit a seven-month-high early this week, following the release of PMI data that showed business activity in Germany’s private sector had picked up slightly in February.

“The election comes against a difficult backdrop for Germany right now, as their economy has just experienced two consecutive annual contractions,” said Deutsche Bank analysts.

“There’s a big debate about what Germany needs to do to boost growth, and a large part of that has centred around whether the new government should pursue a more expansionary fiscal policy, and even reform the constitutional debt brake to allow for more spending.”

Germany’s benchmark 10-year bund yield reached a near one-month high earlier in the week. Meanwhile, euro zone business activity saw tepid growth in February as demand fell at a faster pace, PMI data showed, while French business activity slumped much more than expected in the same month.

Elevated euro zone bond yields also added some pressure to equities, as market participants anticipated increased government borrowing to support defence expenditures. Markets await a speech by European Central Bank’s board member, Philip Lane, later in the day.

London’s FTSE 100 remained largely unchanged after data revealed a surprisingly robust 1.7% rise in British retail sales for January, marking the largest increase since May of the previous year.

Sector-wise, banks emerged as the standout performer of the week, poised to secure its ninth consecutive weekly gain — the longest streak since February 1997. In earnings-driven moves, Standard Chartered climbed 4.1%.

The lender announced a new $1.5 billion share buyback after reporting an 18% rise in annual profit.

The chemicals sector rose to the top among sectors, boosted by a 3.3% rise in Air Liquide after the industrial gases supplier raised its medium-term operating margin guidance after its 2024 sales slightly beat market expectations.

Ireland’s Kingspan jumped 11% after the company reported upbeat 2024 results.

American Dollar Exchange Rate

American Dollar Exchange Rate