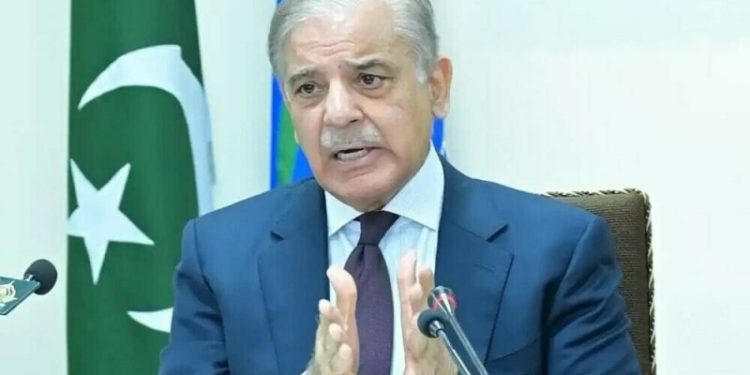

Prime Minister Shehbaz Sharif on Tuesday directed authorities including the Federal Board of Revenue (FBR), Federal Investigation Agency (FIA), and Intelligence Bureau (IB) to take joint action against tax evasion, undocumented sales, and price hikes in sugar sales.

According to a statement released by the Prime Minister’s Office (PMO), a notification has been issued.

PM Shehbaz directed the FBR, IB, and FIA to prevent sales tax evasion in the sugar sector. He also ordered authorities to take strict legal action against sugar mill owners involved in tax evasion and hoarding.

With the sugar crushing season set to begin, PM Shehbaz instructed authorities to ensure 100% GST collection from sugar mills and dealers.

Moreover, the PM also directed the installation of cameras in sugar mills. “The decision aims to prevent hoarding of sugar and ensure price stability,” read the PMO’s statement.

Through cameras, the process and storage in sugar mills will be monitored to ensure payment of sales tax.

As per the PMO’s statement, PM Shehbaz clarified that any increase in sugar prices would not be tolerated. Moreover, the government would undertake a crackdown on speculative trading.

“Strict action has been directed against the sugar speculation mafia,” read the statement.

As per PM instruction, similar actions will be taken in other sectors, including steel, cigarettes, cement, and beverages.

On Monday, PM Shehbaz, during a briefing by the Finance Ministry, directed the authorities to track down tax evaders and their abettors to ensure everyone pays the taxes they owe.

PM Sharif directed for accelerating actions against tax defaulters, and reiterated to bring the tax evaders and their facilitators to book.

“The country’s economy can progress well when all the stakeholders meet their responsibilities. All sectors should pay taxes to play their role in the national progress,” he said.

Prime Minister Shehbaz Sharif on Tuesday directed authorities including the Federal Board of Revenue (FBR), Federal Investigation Agency (FIA), and Intelligence Bureau (IB) to take joint action against tax evasion, undocumented sales, and price hikes in sugar sales.

According to a statement released by the Prime Minister’s Office (PMO), a notification has been issued.

PM Shehbaz directed the FBR, IB, and FIA to prevent sales tax evasion in the sugar sector. He also ordered authorities to take strict legal action against sugar mill owners involved in tax evasion and hoarding.

With the sugar crushing season set to begin, PM Shehbaz instructed authorities to ensure 100% GST collection from sugar mills and dealers.

Moreover, the PM also directed the installation of cameras in sugar mills. “The decision aims to prevent hoarding of sugar and ensure price stability,” read the PMO’s statement.

Through cameras, the process and storage in sugar mills will be monitored to ensure payment of sales tax.

As per the PMO’s statement, PM Shehbaz clarified that any increase in sugar prices would not be tolerated. Moreover, the government would undertake a crackdown on speculative trading.

“Strict action has been directed against the sugar speculation mafia,” read the statement.

As per PM instruction, similar actions will be taken in other sectors, including steel, cigarettes, cement, and beverages.

On Monday, PM Shehbaz, during a briefing by the Finance Ministry, directed the authorities to track down tax evaders and their abettors to ensure everyone pays the taxes they owe.

PM Sharif directed for accelerating actions against tax defaulters, and reiterated to bring the tax evaders and their facilitators to book.

“The country’s economy can progress well when all the stakeholders meet their responsibilities. All sectors should pay taxes to play their role in the national progress,” he said.