Canada’s main stock index edged up on Monday, as investors braced for the U.S. President’s proposed tariffs to take effect and assessed economic data from both Canada and the U.S.

At 10:20 a.m. ET (1520 GMT), the Toronto Stock Exchange’s S&P/TSX composite index was up 0.1% at 25,432.78.

U.S. Commerce Secretary Howard Lutnick confirmed the tariffs on Canada, Mexico, and China would take effect on Tuesday, while President Trump would decide on whether to maintain the proposed 25% tariff rate, leaving investors anxious.

“You could see the TSX pull back as we get closer to tomorrow’s tariff deadline. The effects will be negative on the markets for sure,” said Allan Small, senior investment advisor of the Allan Small Financial Group with iA Private Wealth.

Canadian energy minister Jonathan Wilkinson said in a CNBC interview that if the U.S. imposes tariffs, Canada will retaliate.

The energy sector was the worst performer in the session, with the oilfield drilling and services sector feeling the tremors of the tariff threats, sparking concerns that the anticipated industry recovery might falter if levies were enacted.

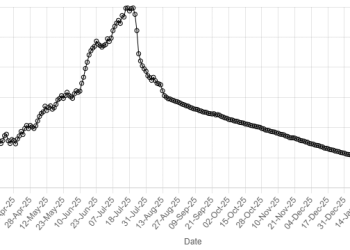

TSX set for monthly loss amid US tariff uncertainty

On the economic horizon, Canadian manufacturing activity contracted for the first time in six months in February as an uncertain trade outlook led to firms turning the most pessimistic since the start of the COVID-19 pandemic.

U.S. manufacturing was steady in February, PMI data showed.

Canadian employment data for the same period will also be unveiled later in the week.

Sector-wise, the materials sector was the top performer, up 1.2%, with gold prices rising due to a weaker dollar and safe-haven buying amid concerns over Trump’s tariff policies.

Meanwhile, oil prices were stable as investors awaited the outcome of efforts to end the Russia-Ukraine war and assessed the repercussions of U.S. tariffs.

Among individual stocks, Interfor lost 9%, hitting a three-week low.

American Dollar Exchange Rate

American Dollar Exchange Rate