Canada’s benchmark index jumped on Wednesday, rebounding from the previous day’s selloff due to strength in commodity-linked shares, while investors digested a better-than-expected U.S. private payrolls reading.

At 10:07 a.m. ET, Toronto’s S&P/TSX composite index was up 0.84% to 30,027.94 points.

The gold sub-index led sectoral movement with a 2.6% rise, tracking gold prices, as investors turned away from risky assets to the metal’s safe-haven appeal.

“Gold has been a very large part of the moves of the TSX… So when gold is moving higher, it tends to take the market up with it,” said Allan Small, senior investment advisor at Allan Small Financial Group with iA Private Wealth.

The region-wide materials index also made outsized moves, rising 1.6%.

Gains on TSX were also inspired by Wall Street, where the benchmark S&P 500 .SPX added 0.24%, after the ADP employment report showed U.S. private payrolls rebounded sharply in October.

Amid a U.S. government shutdown and the lack of key jobs data, investors looked to unofficial reports for clues on the Federal Reserve’s monetary policy.

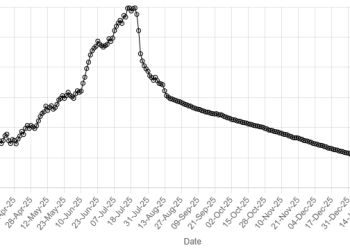

The S&P/TSX composite index has had a stellar 2025, up 21.3%, largely driven by lower borrowing costs and a rally in gold prices. The trade tensions with the U.S., which had influenced trading activities in the beginning of the year, increasingly had little impact on market sentiment.

The TSX’s rebound, with most sectors trading in the green, follows a 1.6% slump in the previous session after major U.S. bank CEOs warned of a potential equity downturn and raised concerns over stretched valuations.

“It’s just one of those things where you wake up and everybody’s questioning valuation on tech stocks, whether it’s the semiconductors or chips in general,” said Small.

Meanwhile, the heavyweight energy index also gained 2%, despite lower crude prices, with Suncor Energy jumping 5% after beating third-quarter profit estimates.

Among other share moves, SSR Mining shed 10.6% after missing third-quarter revenue estimates.

First Majestic Silver dropped 11% after its third-quarter results failed to impress investors.

American Dollar Exchange Rate

American Dollar Exchange Rate