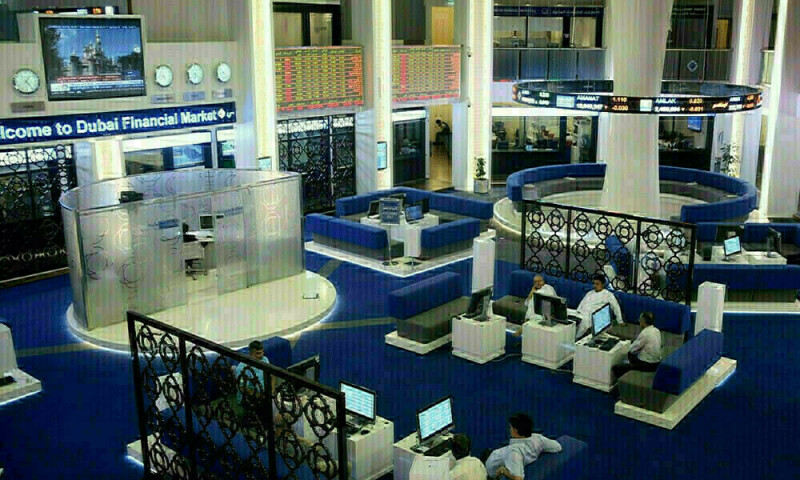

Stock markets in the United Arab Emirates closed lower on Friday, despite rising oil prices, ahead of the upcoming earnings season.

Dubai’s main market declined 0.5%, extending losses from the previous session, as the majority of stocks were trading in negative territory. The industrial and utilities sectors were the major contributors to losses in the index.

Dubai’s toll gate operator Salik Company slipped 2.9% and state-run utility firm Dubai Electricity and Water Authority shed 2.2%.

Dubai’s blue chip developer Emaar Properties said on Thursday it is in talks with “a few groups” in India, including Adani Group, to sell a stake in its Indian business.

Emaar’s shares closed 0.4% down.

Dubai market recorded its second consecutive negative performance, with profit-taking weighing on the final session of the week, said Samer Hasn, Senior Market Analyst at XS.com.

Most Gulf markets gain on hopes of Fed rate cut, Gaza ceasefire

Abu Dhabi’s benchmark index edged lower 0.1%, simulating the previous session’s loss.

The UAE’s largest lender, First Abu Dhabi Bank, and Abu Dhabi Commercial Bank were driving losses in the index with declines of 0.7% and 1.1% respectively.

Reuters, citing sources, reported on Thursday that Sameh Al Qubaisi, head of global markets, and Suhail Bin Tarraf, the bank’s chief operating officer, are set to depart from FAB.

Oil prices – a key contributor to Gulf’s economies – rose on Friday as latest U.S. sanctions on Russian energy trade heightened expectations for oil supply disruptions.

Brent crude was up 0.32% to $81.55 a barrel by 1112 GMT.

—————————————–

ABU DHABI down 0.1% to 9,499 points

DUBAI lost 0.5% to 5,212 points

—————————————–