Stock markets in the United Arab Emirates closed mixed on Friday amid weakening oil prices and Fed rate cut bets as investors eagerly await the U.S. payrolls report due later in the day.

The Fed’s decisions significantly impact the Gulf region’s monetary policy, as most currencies in the region, including United Emirates’, are pegged to the U.S. dollar.

Meanwhile, oil prices, a major driver for Gulf economies, fell as analysts continued to forecast a supply surplus in 2025 despite the OPEC+ decision to postpone planned supply increases and extend deep output cuts to the end of 2026.

Brent crude futures were down 1.03%, to $71.35 per barrel at 1216 GMT.

Abu Dhabi’s index retreated 0.1%, after gaining in the last two consecutive sessions. Abu Dhabi Commercial Bank, UAE’s third-largest bank by assets, fell 1.4% and Alpha Dhabi Holding was down 1.8%.

Most Gulf markets gain on US rate cut bets, OPEC+ output delay

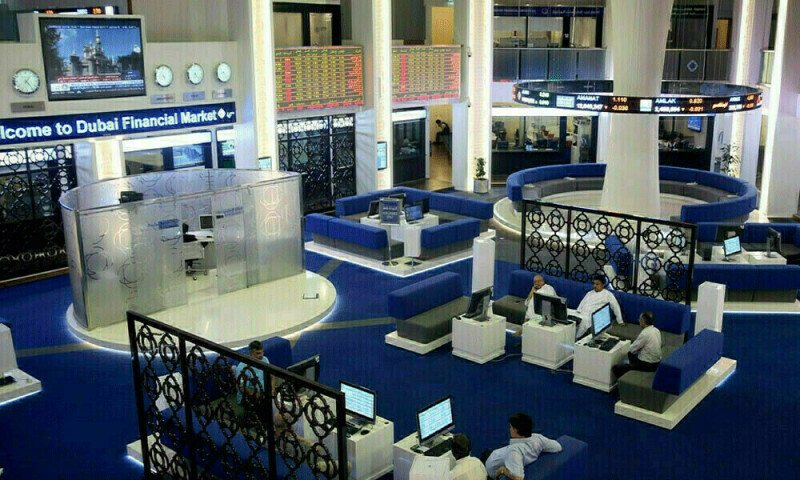

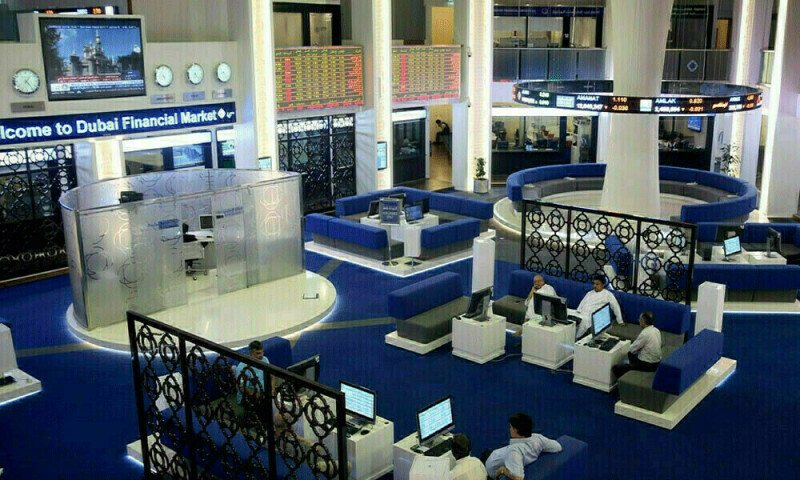

In Dubai, the main share index rose 0.7%, led by gains in almost all the sectors, with Dubai’s largest lender Emirates NBD Bank, and blue-chip developer Emaar Properties gaining more than 1%, while Dubai Electricity and Water Authority was up 2.6%.

----------------------------------------- ABU DHABI fell 0.1% to 9,266 points DUBAI rose 0.7% to 4,854 points -----------------------------------------

Stock markets in the United Arab Emirates closed mixed on Friday amid weakening oil prices and Fed rate cut bets as investors eagerly await the U.S. payrolls report due later in the day.

The Fed’s decisions significantly impact the Gulf region’s monetary policy, as most currencies in the region, including United Emirates’, are pegged to the U.S. dollar.

Meanwhile, oil prices, a major driver for Gulf economies, fell as analysts continued to forecast a supply surplus in 2025 despite the OPEC+ decision to postpone planned supply increases and extend deep output cuts to the end of 2026.

Brent crude futures were down 1.03%, to $71.35 per barrel at 1216 GMT.

Abu Dhabi’s index retreated 0.1%, after gaining in the last two consecutive sessions. Abu Dhabi Commercial Bank, UAE’s third-largest bank by assets, fell 1.4% and Alpha Dhabi Holding was down 1.8%.

Most Gulf markets gain on US rate cut bets, OPEC+ output delay

In Dubai, the main share index rose 0.7%, led by gains in almost all the sectors, with Dubai’s largest lender Emirates NBD Bank, and blue-chip developer Emaar Properties gaining more than 1%, while Dubai Electricity and Water Authority was up 2.6%.

----------------------------------------- ABU DHABI fell 0.1% to 9,266 points DUBAI rose 0.7% to 4,854 points -----------------------------------------