NEW YORK: Wall Street stocks saw a mixed start to trading Monday, on expectations that the Federal Reserve is not in a rush to lower interest rates further while analysts eye earnings reports.

The Dow Jones Industrial Average slipped 0.2 percent to 43,354.99, while the broad-based S&P 500 Index was flat at 5,868.25.

The tech-heavy Nasdaq Composite Index crept up 0.1 percent to 18,701.36.

“We had the post-election rally two weeks ago and then last week, sellers showed up and they erased the post-election rally,” said Adam Sarhan of 50 Park Investments.

Wall Street Week Ahead: Nvidia results in focus as stock market’s election boost stalls

After a quick resolution of the US presidential election, stocks finished at fresh records on November 8.

But this has since faded and markets are “being tested to see if this is a one-off” or if selling will continue, Sarhan added.

Last Friday, stocks closed lower after Fed Chair Jerome Powell signaled the central bank was in no rush to lower rates.

This week, investors will be eyeing chip titan Nvidia’s earnings results, due to be released Wednesday. In particular, they will be looking for clues on demand for its AI chips.

As President-elect Donald Trump announces key appointments in his next administration before he returns to the White House in January, markets are also watching for his nomination of Treasury Secretary.

Among individual companies, Tesla shares surged 7.5 percent early Monday on a report that the Trump administration hopes to ease regulations on self-driving vehicles.

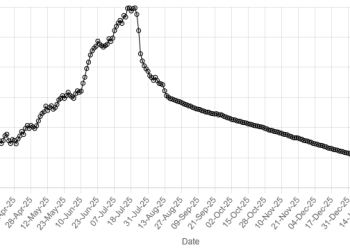

American Dollar Exchange Rate

American Dollar Exchange Rate